Tesla Motors Expects to Generate Profits in 2020

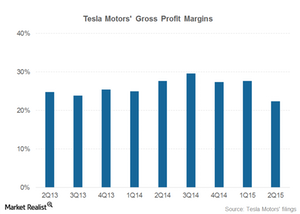

In 2Q15, Tesla’s gross profit margin was 22.3%—much higher than other that of established automakers. Tesla expects to post net profits on GAAP in 2020.

Sept. 9 2015, Updated 12:06 p.m. ET

Tesla Motors

Previously, we noted that Tesla Motors (TSLA) is experiencing huge losses while other automotive companies including Ford (F) and General Motors (GM) are posting record profits. However, this is not a fair comparison for two fundamental reasons.

First of all, the financials of a start-up company such as Tesla should not be compared to those of established companies like Ford and General Motors. Moreover, it is not even clear whether Tesla sees Ford and General Motors as its peer companies. Tesla has established itself as a technology company (XLK) (QQQ) more than an automotive manufacturer.

The second pitfall would be to look exclusively at Tesla’s net profit margins.

Net profits versus gross profits

Tesla is experiencing huge losses, but these are “net losses.” There are several profit metrics that a company reports. The last metric you would want to use when looking at a start-up company would be the net income. A start-up company has to invest heavily in research and development as well as manufacturing plants. Huge investments in the initial phase mean higher expenses during that period.

This would basically render redundant the net income metric. However, looking at the gross profit margins, Tesla has pretty decent ratios. Tesla’s gross profit margin was 22.3% in 2Q15, as can be seen in the chart above. This is much higher than other that of established automakers. Moreover, Tesla has managed to maintain its gross profit in excess of 20% for eight consecutive quarters.

When would Tesla break even?

Tesla expects to post a net profit on GAAP (generally accepted accounting principles) in 2020—or five years from now. However, Tesla’s track record on delivering on key milestones hasn’t really been that great. The company might even miss its target of breaking even on a free cash flow basis.

However, Elon Musk remains overly optimistic about Tesla’s business outlook, as we’ll explore in the next part of the series.