Equinix Trades at a Premium Valuation against Its Peers

Equinix (EQIX) has a TTM price-to-AFFO ratio of 20.2x.

Oct. 26 2018, Updated 9:00 a.m. ET

Price-to-AFFO ratio

Equinix (EQIX) currently trades at a premium against its peers Digital Realty (DLR), CyrusOne (CONE), and QTS Realty (QTS) based on its TTM[1. trailing-12-month] price-to-AFFO (adjusted funds from operations) multiple. Equinix has a TTM price-to-AFFO ratio of 20.2x. Its competitors Digital Realty, CyrusOne, and QTS Realty trade at multiples of 17.7x, 18.7x, and 15.0x, respectively.

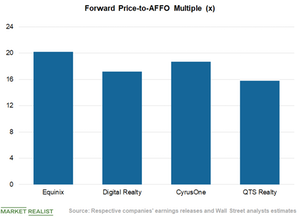

Equinix is also trading at a premium based on Wall Street’s 2018 AFFO expectations with a forward price-to-AFFO multiple of 20.2x. Its peers Digital Realty, CyrusOne, and QTS Realty have multiples of 17.2x, 18.7x, and 15.8x, respectively.

Equinix’s global expansion and acquisition strategies are already yielding incremental revenues and higher profitability. In our view, the company’s prospects look bright and appear to justify its premium valuation against most of its peers.

EV-to-EBITDA multiple

The EV-to-EBITDA[1. enterprise value to earnings before interest, taxes, depreciation, and amortizations] multiple is another widely used multiple for valuing data center REITs. This industry has a high level of debt and operating leases, as well as significant depreciation and amortization amounts on its books. The EV-to-EBITDA multiple neutralizes these factors and is helpful in comparing two REITs with different capital structures as well as distinct asset classes.

Equinix currently trades at a TTM EV-to-EBITDA multiple of 20.3x, which depicts a premium to its competitor QTS Realty’s multiple of 17.6x. However, the company’s EV-to-EBITDA multiple trades at a discount to Digital Realty’s EV-to-EBITDA multiple of 22.0x and CyrusOne’s EV-to-EBITDA multiple of 21.6x.

Equinix constitutes ~4.7% of the Invesco Wilshire US REIT ETF (WREI).