Cliffs Natural Resources 2Q15 Results Miss Estimates

Cliffs Natural Resources announced its 2Q15 earnings on July 29, and its results missed market expectations this time. Cliffs offered positive results six out of the last eight times.

Aug. 4 2015, Published 4:09 p.m. ET

Cliffs’ results are a miss on expectations

Cliffs Natural Resources (CLF) announced its 2Q15 earnings on July 29, and it held the conference call with analysts on the same day. Cliffs’ results were a miss on market expectations this time. It is important to note that Cliffs has a history of beating market estimates, and it has offered positive surprises to the market with its results six out of the last eight times.

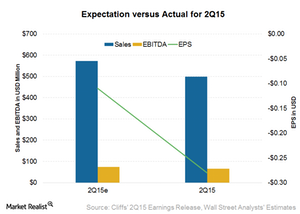

Cliffs reported an EPS (earnings per share) of -$0.28—compared with analysts’ consensus of an EPS of -$0.11. Its EBITDA (earnings before interest, tax, depreciation, and amortization) was also lower at $65 million, compared with analysts’ estimates of $74.2 million. The above graph shows Cliffs’ actual results versus consensus expectations.

Series overview

In this series, we’ll discuss Cliffs’ 2Q15 results and conference call highlights. We’ll look at why Cliffs’ results were a miss on expectations. We’ll also talk about Cliffs’ reasons for downgrading its volume guidance for the US iron ore business.

About Cliffs Natural Resources

Cliffs Natural Resources is mainly an iron ore producer. A small percentage of its revenue comes from metallurgical coal sales. Cliffs accounts for close to 46% of North America’s iron ore pellet supply.

Cliffs has operations in the US, Eastern Canada, and Australia. Recently, it put Eastern Canadian Iron Ore’s assets into bankruptcy. Cliffs has a small direct exposure to the volatile seaborne iron ore market, where mining giants like BHP Billiton (BHP), Rio Tinto (RIO), and Vale SA (VALE) operate.

The rest of the company’s earnings are tied to the legacy contracts in the US with integrated US steel players—including U.S. Steel (X), AK Steel (AKS), and Arcelor Mittal (MT).

The SPDR S&P Metals and Mining ETF (XME) is another way for investors to play the metals and mining space. Cliffs Natural Resources, U.S. Steel, and AK Steel account for 3.0%, 4.4%, and 3.5%, respectively, of XME’s holdings.