Oil Majors Keep New Projects Worth $200 billion on Ice

Wood Mackenzie research shows that the oil majors have deferred more than 45 significant oil and gas projects since the beginning of the crude oil price collapse last year.

Nov. 20 2020, Updated 4:32 p.m. ET

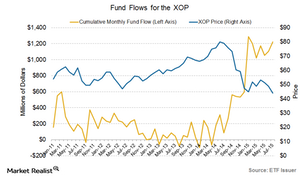

XLE, XOP experience outflows last week

The Energy Select Sector SDPR ETF (XLE) and the SPDR S&P Oil & Gas Exploration & Production ETF (XOP) experienced outflows of about $6.3 million and $18 million, respectively, last week.

Oil majors defer significant projects

According to a July 26, 2015, Financial Times article by Christopher Adams, global oil majors have deferred energy spending worth $200 billion as part of efforts to protect dividends from the effects of slumping oil prices. Oversupply concerns and faltering Chinese growth have pushed the Bloomberg commodities index to its lowest level in six years.

Research by consultancy firm Wood Mackenzie, cited by the article, shows that more than 45 major oil and gas projects have been deferred since the beginning of the crude oil price collapse last year.

Woodside Petroleum (WOPEY) of Australia, Statoil (STO) of Norway, Chevron (CVX) in the US, Royal Dutch Shell (RDS.A), and BP (BP) are among companies that are postponing major production plans as they wait for costs to fall.

More than half of the reserves put on hold lie several thousand feet below the sea, including off the west coast of Africa and the Gulf of Mexico, where the technical demands associated with crude extraction mean escalated project costs. It could cost energy firms several hundred thousands of dollars each day to hire deepwater drilling rigs. That said, such projects could still proceed if the costs associated with hiring contracts fall steeply enough.

In the next part of this series, we’ll discuss the RSI (relative strength index) technical indicator and how its trends affect coal firms and refiners.