Freeport-McMoRan: 2Q15 Earnings, Outlook Fail to Cheer Investors

Freeport-McMoRan (FCX) released its 2Q15 earnings on July 23. It reported a net loss of $1.85 billion, which was largely attributable to the $2 billion write-down of its oil and gas assets.

July 28 2015, Updated 9:31 a.m. ET

Freeport-McMoRan’s 2Q15 earnings

Freeport-McMoRan (FCX) released its 2Q15 earnings on July 23. The company reported a net loss of $1.85 billion. The loss was largely attributable to the write-down of Freeport’s oil and gas assets, which totaled $2 billion. After adjusting for the write-off, Freeport reported net income of $143 million, which translates into an EPS (earnings per share) of $0.14.

Freeport reported a loss of $0.06 per share in 1Q15. It incurred net charges of $2.4 billion, or $2.32 per share, that quarter, primarily for the reduction in carrying value of its energy assets.

This is the second consecutive quarter in which Freeport has partially written off its energy assets. This is in response to the steep drop in energy prices over the last nine months.

Stock price tumbles

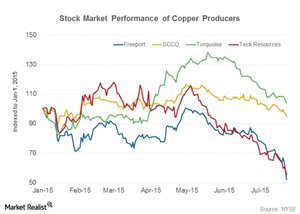

Freeport-McMoRan’s stock price fell ~10% on July 23 after the company released its 2Q15 earnings. The stock has lost ~50% of its value since the beginning of 2015. On July 25, Freeport closed at $12.29, a tad short of its 2008 lows.

Series overview

In this series, we’ll analyze Freeport-McMoRan’s 2Q15 earnings in detail. We’ll explore the various challenges the company faces and also look at its outlook.

Freeport-McMoRan is a leading natural resources company. It’s among the top copper producers and holds the position of largest molybdenum producer. BHP Billiton (BHP) and Rio Tinto (RIO) are among the other leading copper producers.

Freeport currently forms 3.98% of the SPDR S&P Metals and Mining ETF (XME) and 2.8% of the Materials Select Sector SPDR ETF (XLB).

In the next part, we’ll take a look at Freeport-McMoRan’s consolidated 2Q15 earnings.