Economic Growth: Why Is It Important?

Economic growth can be considered among the most crucial indicators that are released. It indicates the growth in economic output.

July 31 2015, Published 12:29 p.m. ET

Monitoring economic indicators

Economic indicators portray the “big-picture” of a country or region in regards to the economy. A single indicator or a small set of indicators attempts to give you an idea of the overall economic health of a particular geography. It can help investors assess whether financial markets are in line with economic fundamentals or if there’s a mismatch. This indicates either a run-up in financial markets ahead of fundamentals or markets that are lagging behind. This information can be useful for investors when they’re making investment and asset allocation decisions.

Whether it’s for ongoing monitoring or studying the fundamentals of an economy for the first time, the indicators discussed in this series will give investors a flavor of how a particular economy is faring. We’ll begin with the most watched data for any economy—economic growth.

Economic growth

Economic growth can be considered among the most crucial indicators that are released. The reason why it’s so important is that it indicates the growth in economic output, whether measured by GDP (gross domestic product), GVA (gross value added), or any other measure.

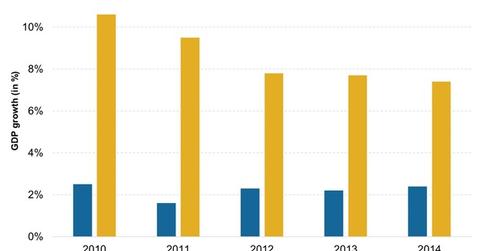

The stage of development of an economy is crucial for comparing two economies. Developed economies have a much slower growth pace YoY (year-over-year) than emerging or developing economies. As a result, comparing the US and China’s economic growth rates won’t be accurate. Instead, comparing the economic growth of countries in the same stage of development—preferably the same geographic region—provides a more comparable picture.

Economic drivers

Assessing economic output also helps investors understand what drives an economy. For instance, over two-thirds of the US economy depends on consumer spending. As a result, if investors get to know that consumer spending in the US is subdued or falling, they can understand that it won’t just impact stocks like Procter & Gamble (PG), Coca-Cola (KO), and Philip Morris International (PM). They account for ~28% of the Consumer Staples Select Sector SPDR ETF (XLP). It will also affect the overall economy and broad market ETFs like the iShares Core S&P 500 ETF (IVV).

From economic growth, let’s move on to the second indicator in focus—inflation.