Crest and Oral-B: Stars in Procter & Gamble’s Health Care Segment

The Health Care segment is P&G’s smallest segment. The segment’s net revenue for the year ending June 30, 2014, was $7.8 billion, or 9.5% of the company’s total net revenue.

July 13 2015, Updated 11:06 a.m. ET

Segment overview

The Procter & Gamble Company, or P&G (PG), is the world’s leading manufacturer and seller of consumer products. P&G’s overall success depends on the growth of its five segments.

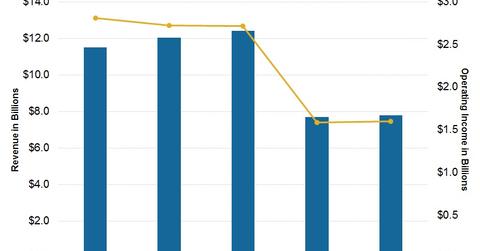

The Health Care segment is P&G’s smallest segment. It includes personal healthcare products in the respiratory category, vitamins, minerals, and supplements, as well oral care products, including toothbrushes and toothpaste. The segment’s net revenue for the year ending June 30, 2014, was $7.8 billion, or 9.5% of the company’s total net revenue, the lowest contribution of all five segments. Health Care’s net income totaled $1.1 billion, accounting for 9.2% of P&G’s net income.

The above chart shows the revenue and operating income contribution of P&G’s Health Care segment.

Health Care brands

Oral care brands Crest and Oral-B fall under the parent company P&G. The company has ~20% of the global oral care market share, second only to its competitor Colgate-Palmolive (CL). Unilever’s (UL) Close-up, Pepsodent, and Signal are some other major oral care brands that compete with P&G in both local and global markets.

In personal healthcare, Vicks and Prilosec OTC—nonprescription heartburn medication—compete in a highly fragmented industry. P&G is a top ten company in personal healthcare on the strength of its Vicks and Prilosec brands. All personal healthcare sales outside the US are done under the name PGT Healthcare, a partnership with Teva Pharmaceuticals (TEVA).

Future outlook

In fiscal 2013, the addition of the PGT Healthcare partnership and New Chapter VMS, partially offset by the divestiture of the PuR business, increased volume in Personal Health Care. Also, the launch of Zzzquil and the geographic expansion of Vicks increased organic volumes by the low single digits in fiscal 2013. The company relies on continued demand for its products. For this reason, it develops and sells brands that will appeal to consumers.

Combined, P&G and Kimberly-Clark (KMB) make up ~2.8% of the SPDR S&P Dividend ETF (SDY). The iShares Core S&P 500 ETF (IVV) invests ~1.2%[1. All ETF portfolio weights are as of June 27, 2015] of its portfolio in P&G.