What Are Colgate’s Strengths and Opportunities?

A strong market position and brand image are some of Colgate’s chief strengths. Colgate holds 44.4% of the global market share in toothpaste.

Aug. 5 2015, Updated 11:05 a.m. ET

Colgate’s brand portfolio

Colgate (CL) is a multinational consumer packaged goods (or CPG) firm. Colgate has a strong brand portfolio that includes Colgate-Total, Colgate Sensitive Pro-Relief, Palmolive soaps, Ajax, and Softsoap. The company sells its products in over 200 countries.

A strong market position and brand image are some of Colgate’s chief strengths. Colgate holds 44.4% of the global market share in toothpaste. In contrast, Procter and Gamble (PG) held 20% of the global market share in oral care for fiscal 2014[1. The fiscal year for Colgate ends December 31, the fiscal year for PG ends June 30]. To learn more about PG’s oral care performance, read Crest and Oral-B: Stars in Procter & Gamble’s Health Care Segment.

[marketrealist-chart id=542024]

Shareholder return performance

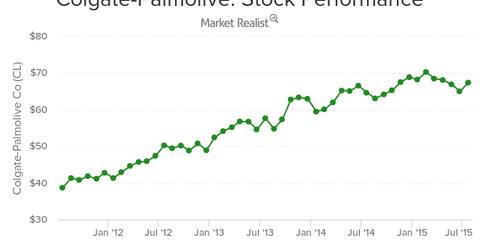

Colgate has also been consistent in terms of shareholder returns performance. Colgate’s total shareholder returns over the period December 31, 2009, to June 30, 2015, came in at ~81.6%. In contrast, the S&P 500 Index and Colgate’s peer group[2. Peer group consists of, Avon Products, Clorox, Kimberly-Clark, Procter & Gamble, Unilever, Reckitt Benckiser, and Beiersdorf AG] returned 107.7% and 61.6%[3. Figures from Company Website], respectively.

Colgate’s relatively non-cyclical nature of business makes it easier for the company to generate consistent returns. Colgate’s major brands consist of toothpaste and related products that are consumer essentials.

Growth in pet nutrition

The growing number of pet owners give Colgate an opportunity to focus on its pet nutrition segment. This segment has huge growth potential, as peers like Clorox (CLX) and Kimberly-Clark (KMB) do not operate in the pet care segment. PG recently completed the divestiture of its pet care business for $2.9 billion to Mars.

Favorable demographics

The rising economic development and consumer incomes in emerging markets like Asia and Africa provide Colgate with opportunities to increase sales in developing markets, which also results in geographical diversification.

Colgate seeks to capture significant opportunities within its core categories by focusing on innovation and developing new products regionally through customer insights. For example, Colgate Active Salt with Neem was launched in India, as the Neem tree in India is known for its antibacterial properties.

CL makes up 0.9%[4. Updated as on July 8, 2015] of the SPDR S&P Dividend ETF (SDY).