How Much Has Under Armour Increased Revenue Guidance?

Under Armour raised the higher end of its 2016 operating income estimate to $503 million–$507 million, implying a growth rate of 23.1%–24.1% over 2015.

Nov. 22 2019, Updated 6:13 a.m. ET

Management’s guidance for 2016

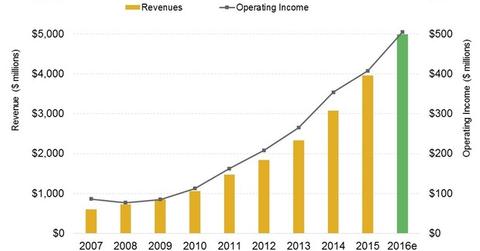

As a result of the higher-than-expected revenue growth in the first quarter, growth stock (IVW) Under Armour (UA) raised its revenue and operating income guidance for 2016. The company now expects sales in 2016 to come in at $5 billion, up from the estimate of $4.95 billion provided in the 4Q15 earnings release in January. This would imply a growth rate of 26.2% over the $4.0 billion in sales reported in 2015. An increase in revenue would likely come from a better-than-average performance in the footwear category and the international segment.

Top line growth expectations for Under Armour’s rivals

The following are revenue growth projections for Under Armour’s competitors:

- Nike (NKE) expects revenue to grow at a mid-single-digit pace in reported terms for both fiscal 4Q16 and fiscal 2016.

- Skechers (SKX) expects 2Q16 sales to come in between $875 million and $900 million, implying growth of 9.3%–12.4% over 2Q15.

- In fiscal 2017, Lululemon Athletica (LULU) expects revenue to increase 10.9%–13.2% to $2.29 billion–$2.34 billion.

- Columbia Sportswear (COLM), which reported its first quarter results on April 28, expects to increase net sales at a mid-single-digit pace in reported terms in 2016.

- VF Corporation (VFC), which will report its first quarter results on April 29, expects to increase revenue at a mid-single-digit pace in reported terms in 2016.

Operating income projections

UA also raised the higher end of its 2016 operating income estimate to $503 million–$507 million, implying a growth rate of 23.1%–24.1% over 2015. Per the earlier guidance provided by the company, operating income was expected to come in at $503 million in 2016.