How Analysts Are Rating Chubb

Chubb (CB) is tracked by 18 analysts in February 2018. One analyst has recommended a “sell” for the stock, and one has recommended a “hold.”

Feb. 5 2018, Updated 9:03 a.m. ET

Ratings on CB

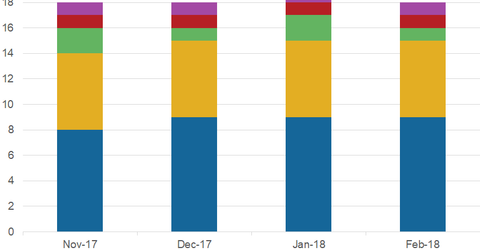

Chubb (CB) is tracked by 18 analysts in February 2018. One analyst has recommended a “sell” for the stock, and one has recommended a “hold.” One analyst has rated it a “strong sell,” and six have rated it a “buy.” Nine analysts have rated the stock a “strong buy.”

Nineteen analysts were tracking CB in January 2018. Two analysts suggested a “hold,” one suggested a “strong sell,” and one suggested “sell.” Nine rated the stock a “strong buy,” and six rated it a “buy.”

Chubb’s competitors

Twenty-one analysts are covering Travelers Companies (TRV) in February 2018. Eleven of them are suggesting a “hold,” three have suggested a “strong sell,” two are recommending a “strong buy,” and five are recommending a “buy.”

TRV was covered by 22 analysts in January 2018. Twelve of them suggested a “hold,” three rated it a “strong sell,” and one recommended a “sell.” Four analysts rated it a “buy,” and two rated it a “strong buy.”

Allstate (ALL) is covered by 20 analysts in February 2018. Six of them are suggesting a “buy,” four are recommending a “strong buy,” and one is suggesting a “sell.” Seven of them are recommending a “hold,” and two are rating it a “strong sell.”

Arch Capital Group (ACGL) is covered by 14 analysts. Eight of them are suggesting a “hold,” and one has rated it a “strong sell.” Two of them are suggesting a “buy,” and three are recommending a “strong buy.”