Merger Update: Charter, Bright House, and Time Warner Cable

California is the only state where the merger between Charter Communications, Time Warner Cable, and Bright House Networks has yet to be approved. It could be approved as early as May 12.

Nov. 20 2020, Updated 11:36 a.m. ET

Charter Communications, Bright House Networks, and Time Warner Cable merger

The merger between Charter Communications (CHTR), Bright House Networks, and Time Warner Cable (TWC) is making progress. A recent report by Reuters stated, “A California administrative law judge recommended approving Charter Communications Inc.’s proposed acquisition of Time Warner Cable and Bright House Networks with some significant conditions, according to a decision made public late on Tuesday.” California is the only state where the deal has yet to be approved, and the California Public Utilities Commission (CPUC) could vote on the deal as early as May 12.

The report also highlighted that the review of the merger by the FCC (Federal Communications Commission) is currently under way.

About the Charter, Bright House, and Time Warner Cable merger

The merger agreement for this deal was signed in May 2015. According to Charter, based on certain assumptions, the transaction value of Time Warner Cable is ~$80.9 billion, and the transaction value of Bright House Networks is $11.4 billion.

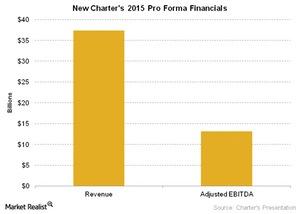

According to Charter, taking the pro forma results of Charter, Bright House, and Time Warner Cable into account, the combined entity would have generated revenue of ~$37.4 billion in 2015. Per the company, based on certain assumptions, the figure for adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) of the combined entity would have been ~$13.2 billion in 2015.

For diversified exposure to some of the largest US cable companies, you might consider investing in the SPDR S&P 500 ETF (SPY). The ETF had a total of ~1.2% of its holdings in Comcast (CMCSA), Time Warner Cable (TWC), and Cablevision Systems (CVC) at the end of March 2016.