What Does Autodesk’s High Price-to-Earnings Ratio Mean in 2015?

In 4Q15, Autodesk’s subscription business grew 17% to $300 million, beating analysts’ estimates. ADSK’s cloud-based products, Fusion 360 and PLM 360, increased its customer base.

June 9 2015, Published 3:18 p.m. ET

Overview of Autodesk

Autodesk’s (ADSK) mission is to empower people to imagine, design, and create a better world. The company’s software products and services allow customers to visualize, simulate, and analyze their projects digitally.

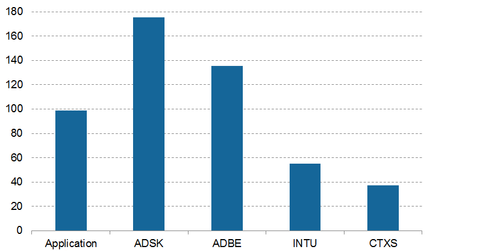

Price-to-earnings ratio of peer companies

In the above chart, you can see that the overall price-to-earnings (or PE) ratio of the application software subsector in the Technology Select Sector SPDR ETF (XLK) is high at 98.80x. Autodesk’s (ADSK) PE ratio is significantly higher at 175.14x.

Other companies that are part of this subsector include Adobe Systems (ADBE), Intuit (INTU), and Citrix Systems (CTXS). They have PE ratios of 135.20x, 55.33x, and 37.24x, respectively.

High growth expectations from Autodesk

One of the main reasons for Autodesk’s (ADSK) high PE ratio is the high growth expectations investors have for the company. The stock has been growing significantly in terms of revenues on a year-over-year basis in the last five years. ADSK shares generated returns of 19.36% in 2014, -8.52% since January 2015, and only 3.37% on a trailing 12-month basis.

With Autodesk’s PE ratio at nosebleed levels, almost ten times higher than the XLK average, it may be no surprise that prices have waned after a strong first half of 2014. Autodesk has been a pioneer in its industry by transforming the sale of traditional software products in boxes to a subscription-based model.

In 4Q15, Autodesk’s subscription business grew by 17% to $300 million, beating analysts’ estimates. ADSK’s cloud-based products like Fusion 360 and PLM (product lifecycle management) 360 performed very well in 4Q15, increasing the company’s customer base.

Analysts’ recommendations

For the full year 2016, ADSK projects revenue growth of 3% year-over-year and 7%–9% on a constant currency basis. Operating expenses for fiscal 2015 increased by 20%, while revenues increased by 7% in comparison. Analysts currently view ADSK shares as overvalued in terms of revenue and growth outlook, since ADSK doesn’t pay dividends to investors.

In the next part of this series, we’ll take a close look at the high PE ratio of Adobe Systems (ADBE).