Citrix Systems Inc

Latest Citrix Systems Inc News and Updates

What Happens to Citrix Stock After the Private Equity Acquisition?

A pair of private equity firms are acquiring Citrix Systems. What will happen to CTXS stock after the acquisition? Here's what investors can expect.

BlackBerry’s Optimism about Enterprise Software and Services

Revenues from BlackBerry’s (BB) Enterprise Software and Services business fell from $91.0 million in fiscal Q2 2018 to $88.0 million in fiscal Q2 2019.

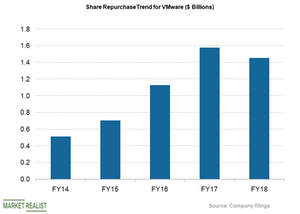

VMware’s Share Buyback Program

As part of VMware’s (VMW) share repurchase program, the company has bought back ~$5.4 billion in shares in the last five years.

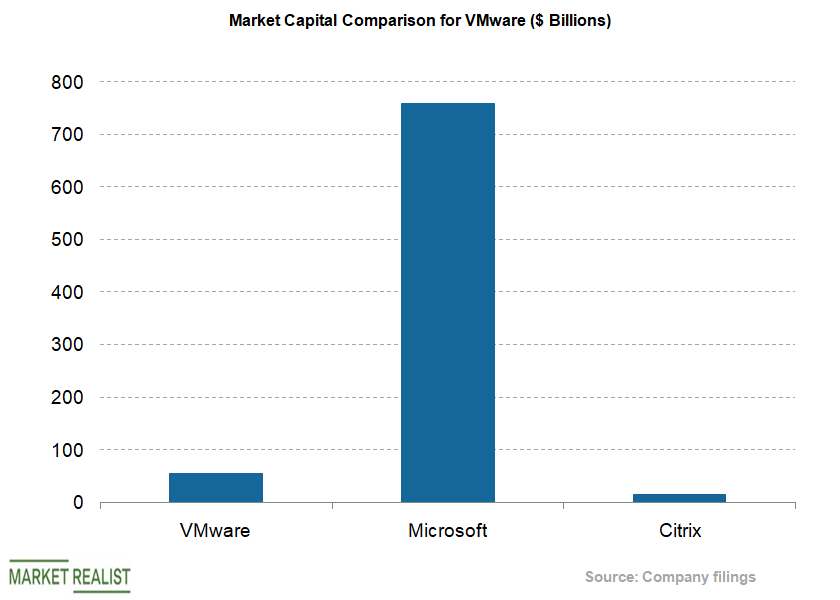

Comparing VMware’s Valuations with Its Peers

On May 22, VMware’s (VMW) market capitalization stood at $55.4 billion.

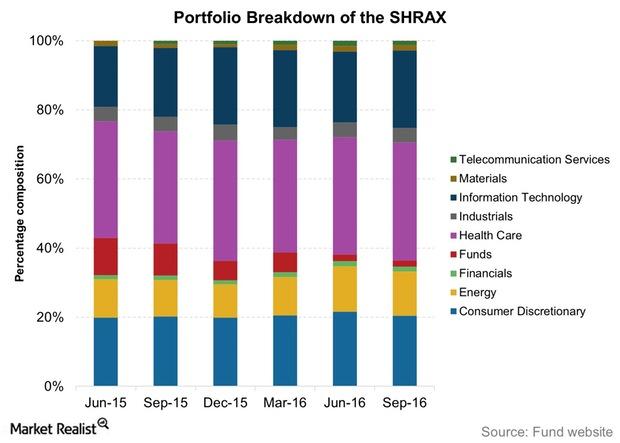

Inside the ClearBridge Aggressive Growth Fund Portfolio

The sectoral breakdown of SHRAX is unlike any other mutual fund in this review, with healthcare as its biggest holding, commanding 35% of the portfolio.

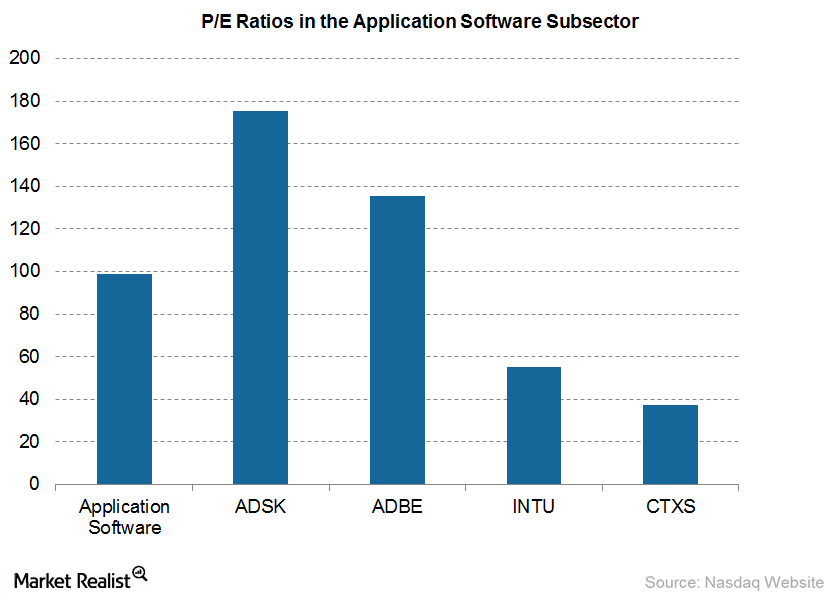

What Does Autodesk’s High Price-to-Earnings Ratio Mean in 2015?

In 4Q15, Autodesk’s subscription business grew 17% to $300 million, beating analysts’ estimates. ADSK’s cloud-based products, Fusion 360 and PLM 360, increased its customer base.

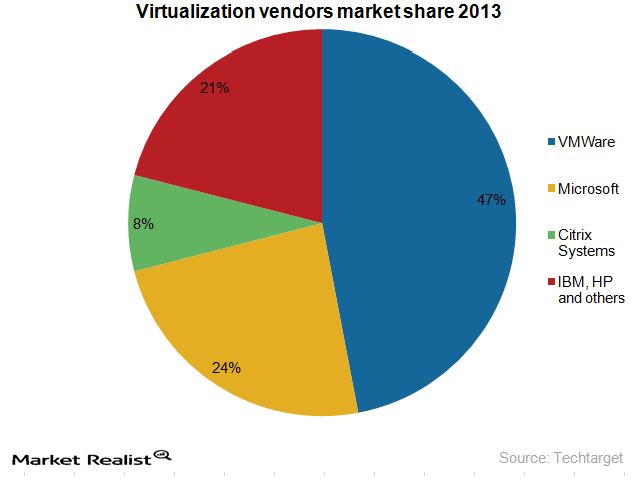

Why “big data” and “virtualization” go hand in hand?

“Big data” analysis requires large data set analysis and the creation of advanced analytic algorithms that are designed to identify insights, patterns, and trends that aren’t understood yet.