Why Growth in MasterCard’s Gross Dollar Volume is Important

The US accounts for 32% of MasterCard’s total gross dollar volume. The Asia-Pacific, Middle East, and Africa contribute 31%, and Europe accounts for 27% of the total volume.

June 25 2015, Updated 5:11 a.m. ET

Volume drives fees

MasterCard (MA) charges fees to issuers and acquirers based primarily on the gross dollar volume (or GDV) of activity on its cards. This fee, which includes domestic assessments and cross-border volume fees, which we discussed previously, accounts for more than half of MasterCard’s total revenues. So, growth in the company’s gross dollar volume is a crucial metric to monitor.

MasterCard’s April 29, 2015, press release defines GDV, purchase, and cash volume as the “purchase volume plus cash volume and includes the impact of balance transfers and convenience checks; ‘purchase volume’ means the aggregate dollar amount of purchases made with MasterCard-branded cards for the relevant period; and ‘cash volume’ means the aggregate dollar amount of cash disbursements obtained with MasterCard-branded cards for the relevant period.”

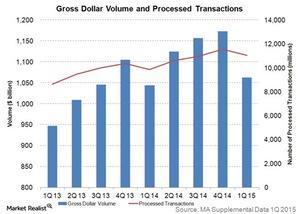

The graph above shows growth in MasterCard’s gross dollar volume over the past two years. The volume is seasonally down in the first quarter of each year, similar to a trend in Visa’s (V) volume. You can read more about this trend in Visa Continues to See Growth in Key Operational Metrics. Purchase volume accounts for 74% of MasterCard’s total gross dollar volume.

Rapid growth in non-US geographies

The United States accounts for the highest gross dollar volume, contributing 32% to MasterCard’s total gross dollar volume. APMEA (Asia-Pacific, Middle East, and Africa) contribute 31% to the total volume, and Europe accounts for 27% of the total volume.

The above graph shows the geographic breakdown of MasterCard’s total gross dollar volume. While the US contributes most heavily to the total volume, its growth rate is the lowest among all regions. In the latest quarter, APMEA, Canada, and Europe recorded a volume growth of nearly 15% in local currency.

Latin America recorded 14.2% growth in volume, whereas the growth was 6.6% for the US. The rapid growth in emerging markets is attributed to the fact that MasterCard’s penetration in these economies is still very low, as cash and checks are still the predominant modes of payment.