Rationale for Capgemini’s Acquisition of IGATE

The acquisition bolsters Capgemini’s exposure in the financial verticals—where IGATE is particularly strong—as well as manufacturing, retail, and healthcare.

May 11 2015, Updated 10:05 a.m. ET

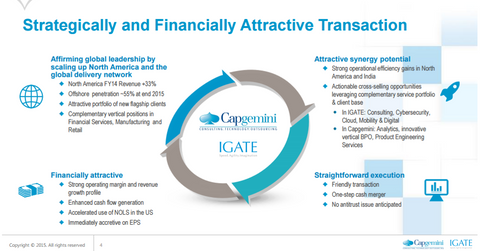

Capgemini has been keen to increase its North American exposure

Capgemini has been interested in increasing its North American exposure for quite some time, and IGATE (IGTE) makes a good acquisition. The acquisition bolsters Capgemini’s exposure in the financial verticals—where IGATE is particularly strong—as well as manufacturing, retail, and healthcare. The transaction will take Capgemini’s European footprint from 70% of revenues to 62%.

Benefits for Capgemini

Paul Hermelin, chairman and CEO of Capgemini, said, “I am very pleased to announce a very important transaction in Capgemini’s history. IGATE is a leading company that perfectly fits our strategic ambition. It will give us a new status on the American market, and take further our industrialization journey to offer ever more competitive services to our clients. This will also give to the Group’s Indian operations a new scale, allowing us to compete on par with the best US-based and Indian-based companies. I am glad to welcome new talents and leaders to our Group, who share our convictions and professional culture.”

Pro forma financials and synergies

The combined company will have estimated revenues of $12.5 billion in 2016, and Capgemini expects the acquisition to increase Capgemini’s operating margins by 100 basis points. The company expects the transaction to be at least 12% accretive to 2016 earnings per share and at least 16% accretive in 2017.

Capgemini expects to generate $30 million to $40 million in synergies out of SG&A (selling, general, and administrative expenses) and facilities. It also estimates $100 million to $150 million in revenue synergies from cross-selling. Note that Capgemini has something like $3 billion in net operating losses in North America that can be tapped as well.

Merger arbitrage resources

Other important merger spreads include the deal between Baker Hughes (BHI) and Halliburton (HAL) or the merger between Pharmacyclics (PCYC) and AbbVie (ABBV). For a primer on risk arbitrage investing, read Merger arbitrage must-knows: A key guide for investors.

Investors interested in trading in the tech sector should look at the Sector SPDR Trust SBI Interest (XLK).