Making Sense of Economic and Insured Losses

Insured losses are the ones that impact the profitability of insurance companies.

April 3 2015, Updated 2:07 p.m. ET

Economic losses

Economic losses in a catastrophic event exclude those that are not financial in nature. All economic losses do not translate in insured losses, however.

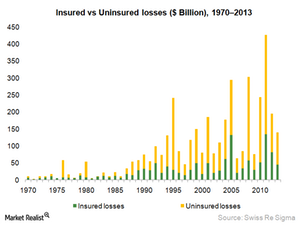

Insured losses

Insurance companies like AIG (AIG), ACE (ACE), Travelers (TRV), Chubb (CB), and others that are part of the Financial Select Sector SPDR ETF (XLF) and the iShares US Financials ETF (IYF) receive claims that cover only a portion of economic losses. This is because people do not have insurance against all property damage or other losses prior to the occurrence of a catastrophic event. Since 1970, insured losses have represented only about 30% of all economic losses.

Insurance penetration and density

Insured losses are the ones that impact the profitability of insurance companies. These losses are more commensurate with economic losses overall in countries where insurance penetration and density remain high. This is because insurance companies sell more policies in those places. Natural catastrophes result in lower insured losses in countries with less insurance penetration and density.

Hurricane Katrina caused economic losses of $125 billion. This catastrophic event saw a higher proportion of insured losses at $62 billion than did the 2011 earthquake in Japan, which caused overall losses of about $210 billion and insured losses of around $40 billion. Japan’s lower non-life insurance penetration—1.6% of GDP—in comparison to that of the US—4.3% of GDP in 2013—might explain the differing economic losses.

In the next article, we will look at some major catastrophe losses.