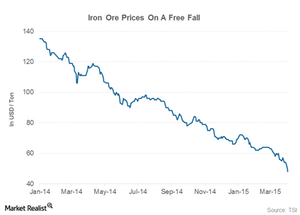

Iron Ore Prices Fall Below $50 Per Ton

The iron ore price slide has been particularly pronounced in the last few weeks, as Chinese demand didn’t pick up as expected after the New Year holiday.

April 10 2015, Updated 10:20 a.m. ET

Iron ore price performance

Iron ore prices have tumbled below the psychological $50-per-ton barrier. Prices almost fell to a 10-year low of $47.08 on April 2. The prices have already fallen by 27% YTD (year-to-date) in addition to the 47% fall they experienced in 2014. The prolonged fall in prices is taking a toll on iron ore companies.

No bottom in sight

The iron ore price slide has been particularly pronounced in the last few weeks, as Chinese demand didn’t pick up as expected after the New Year holiday. China also cut the interest rates in March for the second time in four months. Despite all these efforts, iron ore prices aren’t showing signs of bottoming out.

The main problem with the iron ore sector currently is the oversupply situation created by iron ore miners, including BHP Billiton (BHP), Rio Tinto (RIO), and Vale (VALE). Oversupply, coupled with weak demand from China, which constitutes two thirds of the overall seaborne demand, is leading to an unprecedented fall in iron ore prices.

Series overview

In this series, we’ll discuss a few indicators relating to iron ore exports from Australia and Brazil, iron ore inventories, and China’s manufacturing PMI to help understand the direction iron ore prices will be taking. Most of these indicators are published monthly. Other indicators are reported weekly or quarterly. Regardless, these indicators should be looked at collectively, as they give investors clues about the future direction of iron ore prices. They also give investors insight into the share prices of companies, including Rio Tinto (RIO), BHP Billiton (BHP) (BLT), Vale (VALE), and Cliffs Natural Resources (CLF).

BHP Billiton, Rio Tinto, and Vale form 31.4% of the iShares MSCI Global Metals & Mining Producers ETF (PICK). Some of these companies are included in the SPDR S&P Metals and Mining ETF (XME).