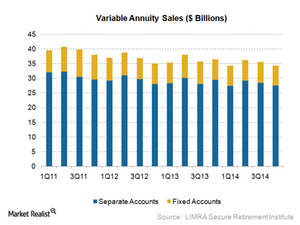

Variable Annuity Sales Lower in 2014

Compared to 2013, variable annuity sales were down by ~3.6% in 2014, at around $140 billion, despite a strong performance in the equity markets.

April 2 2015, Updated 6:06 p.m. ET

Variable annuities

Variable annuity products are a popular product class in the United States. Top players in the variable annuity market are Lincoln National Corporation (LNC), American International Group (AIG), Prudential Financial (PRU), Principal Financial (PFG), and MetLife (MET).

Other life insurers held in financial sector ETFs such as the iShares U.S. Financials ETF (IYF) also compete in the variable annuity market.

Drop in sales

The drop in sales of variable annuities continued in 2014, according to data provided by the LIMRA Secure Retirement Institute, Insured Retirement Institute, and Morningstar. Compared to 2013, variable annuity sales were down by ~3.6% in 2014, at around $140 billion.

Since they’re heavily invested in equities, which made up more than 40% of allocated assets at the end of 2014, their performance closely tracks the movement of the equity markets. We’ve outlined this in our industry overview, An investor’s guide to the insurance business. However, recent periods saw a contraction in the variable annuity sales despite a strong performance in the equity markets.

According to John McCarthy, Morningstar’s senior product manager for annuity products, “Sales were affected by strategy shifts and product line rationalization among the major carriers.” In a Market Realist overview of Prudential, we looked at a similar strategic stance of Prudential Financial. MetLife also reported right-sizing of its variable annuity portfolio, as we mentioned in our overview of MetLife’s business.

Net flows and assets

The industry continued to see net outflows of assets, which implied higher redemptions compared to sales, or more dollars going out than coming in. However, assets under management continued to increase as net outflows were offset by the performance of equity markets. Net assets increased to $1.92 trillion at the end of 2014, compared to $1.87 trillion at the end of 2013.

In comparison, fixed annuities saw strong growth in sales across product lines. We’ll look at fixed annuity sales in the next article.