Energy Transfer Partners’ Fee-Based Model Drives Performance

Considering the rock solid performance of ETP during the slump in energy prices, it is clear that ETP has more fee-based contracts.

May 6 2015, Updated 8:05 a.m. ET

MLP fee-based model

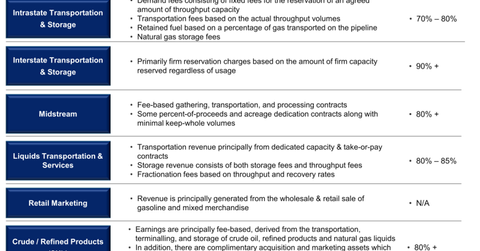

MLPs (or master limited partnerships) generally operate as a toll road business with revenues linked to the fixed fee charged for the volumes of crude oil, natural gas, and NGLs transported, processed, treated, and compressed. Other than the fee-based model, MLP revenues are exposed to energy prices.

ETP exposure to commodity prices

Considering the rock solid performance of Energy Transfer Partners (ETP) during the slump in energy prices, it is clear that ETP has less exposure to commodity prices and has more fee-based contracts. Apart from the Retail Marketing segment, which is exposed to the refined product prices, as it sells gasoline and other refined products directly to the market, all other segments had less than 80% of their revenue tied to fee-based contracts.

Hedging strategy

Although the majority of ETP’s revenue is fee-based, a drop in energy prices like the one the industry is facing currently, can lead to huge losses. To protect themselves from such conditions, MLPs reduce their commodity price exposure by taking positions in derivative products such as swaps, futures, and options. Energy Transfer Partners was successful in reducing most of its commodity exposure during 2014. As of September 30, 2014, only 5.5% of the total adjusted EBITDA was unhedged or exposed to commodity price movements.