How Catastrophes Impact a P&C Insurer’s Combined Ratio

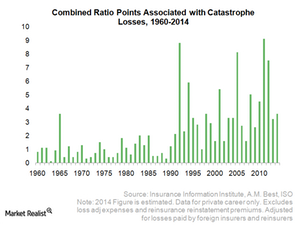

The percentage points for catastrophe losses in the combined ratio have increased in recent years.

April 2 2015, Updated 4:06 p.m. ET

Combined ratio

The combined ratio measures the profitability of a P&C insurance business. This metric has two components:

- the loss ratio, which compares the claims paid to the premiums received

- the expense ratio, which is the proportion of the expenses paid out of the premium

A combined ratio below 100% implies an underwriting profit, while a ratio above 100% indicates an underwriting loss. Clearly, the higher the combined ratio is, the lower the profitability is. For more information on the combined ratio, please read our investor’s guide to the insurance business.

Catastrophe losses

As a proportion of premiums received, catastrophe-related claims form a part of the combined ratio by way of the loss ratio. However, insurers also normally report losses that arise due to catastrophes separately.

Catastrophes result in increased loss ratios, which in turn create higher combined ratios. A higher combined ratio reflects lower profitability. As shown in the chart above, the percentage points for catastrophe losses in the combined ratio have increased in recent years.

Large natural catastrophes, which severely impact the profitability of a P&C insurer, can also mark the beginning of an increasing P&C rate cycle. For more information on the P&C rate cycle, read our series Is a Soft Market Ahead? A Closer Look at P&C Insurance Rates.

Since catastrophes are one-time events. For this reason, it is helpful to remove their impact from the combined ratio calculations so that a clearer picture of a P&C insurer’s profitability can emerge.

Insurers like AIG (AIG), ACE (ACE), Travelers (TRV), and Chubb (CB) are part of the Financial Select Sector SPDR ETF (XLF). They also make up a part of the iShares Dow Jones US Financial ETF (IYF).