Under Armour’s Stock Surges after 1Q17 Earnings

Under Armour’s (UAA) stock rose 10% as the company reported better-than-expected 1Q17 top and bottom lines and maintained its fiscal 2017 guidance.

May 1 2017, Updated 7:39 a.m. ET

Market reaction to Under Armour’s 1Q17 results

Under Armour’s (UAA) stock rose 10% as the company reported better-than-expected 1Q17 top and bottom lines and maintained its fiscal 2017 guidance.

Under Armour’s chairman and CEO, Kevin Plank, said, “By proactively managing our growth to deliver superior innovative product, continuing to strengthen our connection with consumers and increasing our focus on operational excellence – we have great confidence in our ability to drive toward our full-year targets.”

Under Armour is now trading at $21.67. The company’s year-to-date losses fell to 25%. The stock currently trades 112% below its 52-week high price.

In comparison, competitors Nike (NKE) and Lululemon Athletica (LULU) have gained 9% and 2.5%, respectively, this year. Under Armour remains among the worst-performing apparel and accessory companies this year.

A look at Wall Street’s recommendations on UAA

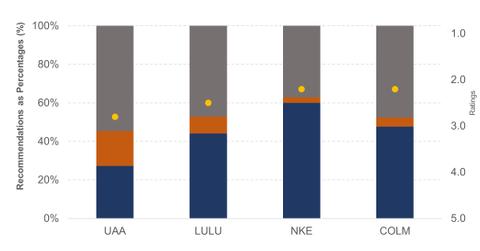

UAA is covered by 33 Wall Street analysts, who have jointly rated the company 2.8 on a scale of 1 (strong buy) to 5 (sell). In comparison, peers Lululemon Athletica (LULU), Columbia Sportswear (COLM), and Nike (NKE) have received ratings of 2.5, 2.2, and 2.2 from Wall Street, respectively.

Of the 33 analysts, 18% have a “sell” recommendation on UAA and 27% of analysts suggest buying the stock while 55% recommend holding it.

The average 12-month price target on the company is $21.33, indicating a downside of 2% over the next year. Jefferies and Canaccord Genuity raised their price targets on UAA after the 1Q17 results.

Jefferies raised the price target to $28.00 from $27.00 while maintaining the “buy” rating. Canaccord Genuity increased its price target to $21.00 from $20.00 and reaffirmed its “hold” rating on the stock.

ETF investors seeking to add exposure to UAA can consider the PowerShares S&P 500 High Beta Portfolio (SPHB), which invests ~1% of its portfolio in the company.