Verizon’s Wireless Revenues Grew in 4Q14

Verizon (VZ) reported its 4Q14 results on January 22, 2015. We’ll analyze the company’s quarterly performance while focusing on Verizon’s wireless revenues.

March 26 2015, Published 1:27 p.m. ET

Verizon’s Wireless division

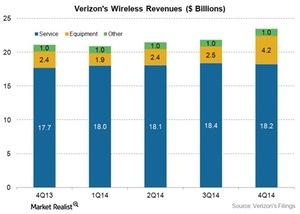

Verizon (VZ) reported its 4Q14 results on January 22, 2015. In this series, we’ll analyze the company’s quarterly performance while focusing on the results of Verizon’s wireless division. Like AT&T (T), Verizon operates in both the wireless and wireline spaces. However, wireless is Verizon’s largest segment. In terms of size, the company’s wireless division reported ~$23.4 billion in revenue, while the wireline segment’s revenue was ~$9.6 billion in 4Q14. In terms of profitability, the wireless segment’s operating income was ~$5.5 billion, while that of the wireline segment was ~$0.4 billion in 4Q14.

Equipment revenues drove growth in Verizon’s wireless segment

Verizon’s wireless revenues grew by ~11%, year-over-year in 4Q14. The growth in revenues came predominantly from equipment sales. The division’s equipment revenues increased by a significant ~74% year-over-year during the quarter. Equipment sales include devices such as basic phones, smartphones, and tablets. Verizon’s service revenues increased by ~3% year-over-year during the quarter. Service revenues are a stable revenue stream for telecommunication companies.

Verizon’s wireless division’s revenues also grew sequentially during the quarter. They increased by ~7% in 4Q14. This increase came despite a ~1% sequential decline in the company’s service revenues during the quarter. The company’s equipment revenues drove the sequential growth in its wireless division’s revenues in 4Q14. They increased by ~70% sequentially during the quarter.

Verizon: The largest domestic telecommunications player

Verizon is the largest US telecommunications company. It represented ~12.6% of the iShares U.S. Telecommunications ETF (IYZ) and ~5% of the Technology Select Sector SPDR Fund (XLK) on March 19, 2015. AT&T (T) is the second-largest domestic telecom player. It represented ~11.6% of IYZ on the same date.

In the wireless space, the other large national carriers are Sprint (S) and T-Mobile (TMUS). Together, they represented ~10.1% of IYZ on March 19, 2015.