T. Rowe Price Group: It Takes Seed Capital to Build New Funds

The length of time seed capital is held in a portfolio depends on various factors such as how long it takes to generate cash flow from unrelated investors.

March 19 2015, Updated 1:05 p.m. ET

Products offering innovation

The mutual fund industry has grown significantly over the past few decades. It now has $30 trillion in total assets under management. Almost half these assets are managed in US equities and other asset classes.

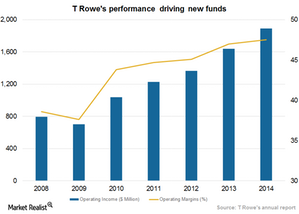

T. Rowe Price Group manages $477 billion under its sponsored funds category. The company has to constantly innovate on the offerings front in order to gain market share in and outside of the US. Given the demand for new ideas from various regions, it has launched several new funds over the past few years.

In 2014, the company introduced three new equity products:

- Frontier Markets

- Asia Opportunities

- International Concentrated Equity

It also introduced three products in the fixed income category:

- Credit Opportunities

- Dynamic Global Bond

- Intermediate Tax Free High Yield

Seed capital for new funds

T. Rowe Price Group (TROW) builds its team and portfolios with seed capital for new investments. The seed capital allows the portfolio manager to build an investment performance track record. Once established, the performance track record attracts sustainable client assets.

The length of time seed capital is held in a portfolio depends on various factors including how long it takes to generate cash flow from unrelated investors, performance history, and the sustainability of assets. Measures are taken to ensure that returning the capital to the company doesn’t negatively impact the new investment portfolio’s net asset value or its overall performance.

Of the total capital disbursed by the company, almost 39% is for seeding investments. This reflects the company’s focus on offering new and innovative funds across asset classes and regions.

In attracting new capital, T. Rowe faces competition from BlackRock (BLK), Invesco (IVZ), Franklin Resources (BEN), Legg Mason (LM), and Affiliated Managers (AMG). Together these companies make up 2.77% of the Financial Select Sector SPDR Fund (XLF).