Olive Garden: Darden’s Most Important Brand

In 2014, Olive Garden contributed about 58% to Darden’s revenues as of fiscal 2014. Olive Garden gained importance after Darden sold Red Lobster in 2014.

March 18 2015, Updated 12:05 p.m. ET

Top brand

Olive Garden contributed about 58% to Darden Restaurant’s (DRI) revenues as of fiscal 2014, making it the group’s top brand. Olive Garden became even more important after Darden sold Red Lobster in July 2014.

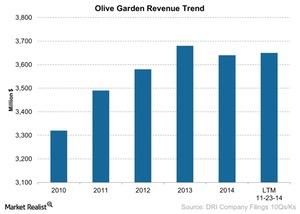

As shown in the chart above, the revenue from Olive Garden increased from 2010 to 2013. It declined again in 2014, settling at $3,640 million from $3,680 million in 2013.

Olive Garden menu

Olive Garden is a full-service casual restaurant serving Italian cuisine in the US. The menu includes appetizers, soups, sandwiches, pasta dishes and other Italian specialties, and desserts. Olive Garden also offers a combo menu, which includes soup, salad, breadsticks, and a mini pasta bowl. The restaurant also offers a children’s menu and a low-calorie menu. As of fiscal 2014, there were 837 Olive Garden restaurants out of the total 1,501 restaurants in the system.

According to the company filings, dinner entrees at Olive Garden cost in the range of $10–$20, and lunch entrees cost from $7–$17, including unlimited salad or soup and breadsticks.

The competition

Olive Garden competes with restaurants such as Maggiano’s Little Italy under the umbrella of Brinker International (EAT), Carrabba’s Italian Grill under the umbrella of Bloomin’ Brands (BLMN), and The Cheesecake Factory (CAKE). These three restaurants have similar menu offerings and price points.

Investors can gain exposure to restaurant stocks through ETFs such as the Consumer Discretionary Select Sector SPDR ETF (XLY). XLY holds about 10% of its portfolio in restaurant stocks.