Why the NASDAQ’s 5,000 Level Is Not Like the Dot Com Bubble

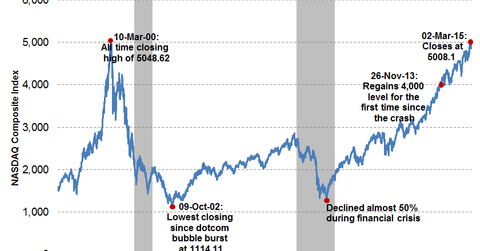

The NASDAQ hit the all-important 5,000 level on March 2, 2015, for the first time after the dot com bubble burst of 2000.

May 4 2021, Updated 10:39 a.m. ET

As the Nasdaq Composite Index hit the 5,000 mark for the first time in 15 years, many are asking if we’re seeing another bubble. Heidi Richardson doesn’t think so because today’s investors realize that earnings matter.

The Nasdaq slipped below the 5,000 high-water mark it reached in the first week of March, but it regained those levels last week. The last time it hit above 5,000 was in March 2000.

Back then, investors were riding high, only to suffer a sickening fall as the technology-heavy index lost half its value by year-end. Fifteen years later, investors are worried another bubble may be on the horizon. But much has changed since the turn of the century. And while some sectors may appear over-valued, we believe others still have room to grow.

Market Realist – Irrational exuberance drove the tech-heavy NASDAQ index (QQQ) from 1,000 points in 1995 to 5,000 points in 2000. The descent from the top was quick and extremely painful. From 5,046 in March 2000, the NASDAQ crashed a whopping 78% by October 2002. The technology sector (XLK) would take an arduous 15 years to regain its swagger. According to a report by Dr. Brent Goldfarb in the Journal of Financial Economics, only 48% of the dot com companies floated at the time lived to tell their tale beyond 2004, with Amazon (AMZN), Google (GOOG) and eBay (EBAY) being the noteworthy successes.

The NASDAQ hit the all-important 5,000 level on March 2, 2015, for the first time after the dot com bubble burst of 2000. It’s natural for investors to feel a little jittery. However, much has changed since the market mania that engulfed tech stocks (IYW) in 2000. Reverting and giving up gains is a possibility that markets always face. However, there are some critical differences between the markets then and the markets now that mean the NASDAQ at 5,000 is not reminiscent of the dot com bubble. We’ll discuss these reasons in detail in this series.