HPE Continues to Lead the Worldwide Server Systems Market

Hewlett Packard Enterprise (HPE) continued to lead the worldwide server market with a share of 25.4% in 2Q16.

Nov. 14 2016, Updated 12:04 p.m. ET

Hewlett Packard Enterprise has a 25.4% share in the server systems market

According to IDC (International Data Corporation), revenue in the worldwide server market fell 0.4% YoY (year-over-year) in 2Q16 to $13.4 billion. IDC stated that this was the second consecutive YoY decline driven by a “pause in hyperscale server deployments” after seven consecutive quarters of growth.

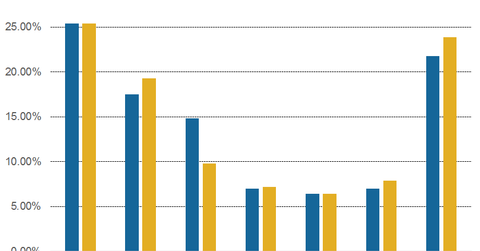

In 2Q16, worldwide server shipments rose 2.6% YoY to 2.4 million units. Hewlett Packard Enterprise (HPE) continued to lead the worldwide server market with a share of 25.4% in 2Q16. HPE revenues fell 0.3% YoY to $3.4 billion.

Dell was the second-largest player in this market with a share of 19.3%, up from 17.5% in 2Q16. Its revenue rose 10% YoY to $2.6 billion in 2Q16. IBM (IBM) maintained the third position in this market with revenues of $1.3 billion and a share of 9.8%. Revenue fell 34% YoY for IBM in 2Q16 and market share fell significantly from 14.8% in 2Q15.

Lenovo and Cisco are other major players in this space

China’s (FXI) Lenovo (LNVGY) and Cisco (CSCO) are other major players in the server market with shares of 7.2% and 6.4%, respectively. Revenues for Lenovo rose 2.1% YoY to $969 million. Revenues for Cisco fell 0.7% YoY to $860 million in 2Q16.

According to Kuba Stolarski, research director for computing platforms at IDC, “The server market is progressing exactly as expected, with close to flat growth in the second quarter, following a difficult first quarter, but growth in volume servers is still healthy, which is a good sign for the market moving forward.”