A Business Overview of Cliffs Natural Resources

Cliffs Natural Resources’ (CLF) key driver is global demand for the raw materials used to make steel.

April 7 2015, Updated 5:07 p.m. ET

Cliffs Natural Resources

Cliffs Natural Resources (CLF) is mainly an iron ore producer. A small percentage of its revenue comes from metallurgical coal sales. Iron ore and metallurgical coal are key raw materials used in steel production.

Cliffs accounts for close to 46% of North America’s iron ore pellet supply. Pellets are produced through agglomeration and thermal treatment. Iron ore grades range from 67% to 72%.

Cliffs has operations in the United States, Eastern Canada, and Australia.

Cliffs’ key segments

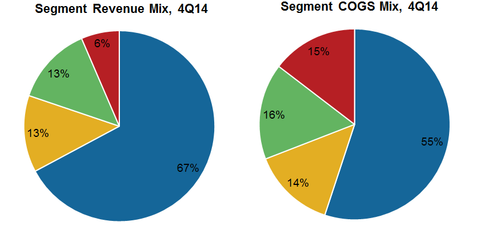

Cliffs’ key segments are organized mainly by product and geography. The following are Cliffs’ key segments:

- US Iron Ore, or USIO

- Eastern Canadian Iron Ore

- Asia Pacific Iron Ore, or APIO

- North American Coal, or NAC

Recently, it put Eastern Canadian Iron Ore’s assets into bankruptcy.

Revenue and EBITDA contribution

In 4Q14, iron ore contributed 90% of the company’s total sales value. The rest of its total sales were from coal.

The company’s EBITDA (earnings before interest, taxes, depreciation, and amortization) from iron ore is still higher. Out of its iron ore subdivisions, USIO production is the key driver of the company’s EBITDA.

More than 50% of Cliffs’ sales is linked to the benchmark price. The benchmark price is 62% of cost and freight (CFR) in China. Meanwhile, the remainder of the sales, contributed by the USIO segment, are more stable. Long-term contracts make it much more predictable.

Key driver

Cliffs Natural Resources’ (CLF) key driver is global demand for the raw materials used to make steel. This is also the driver for any other iron ore and metallurgical coal company. Much of this demand comes from emerging and developed economies. The United States and China are Cliffs’ two key markets.

Other companies in the industry operate in mostly the seaborne market. These companies include BHP Billiton (BHP) and Rio Tinto (RIO) in Australia. It also includes Vale S.A. (VALE) in Brazil. Cliffs makes up 2.9% of the SPDR S&P Metals & Mining ETF (XME). XME provides a broad exposure to the iron ore industry.