The AWS-3 Acquisition Adds Depth to Verizon’s Spectrum Holdings

According to Verizon, the AWS-3 spectrum acquisition helped it gain depth in its spectrum holdings.

April 8 2015, Updated 5:05 a.m. ET

AWS-3 for managing high data traffic

In the previous part of this series, we saw that Verizon (VZ) won significant holdings in the FCC’s (Federal Communications Commission) auction for the AWS-3 spectrum. AT&T (T) and T-Mobile (TMUS) also participated in this spectrum auction.

The spectrums can be segregated into low, mid, and high bands based on their frequencies. As you move from low-band to high-band spectrums, the data traffic capacity increases. However, this increase comes at the cost of decreasing coverage. AWS-3 is a band of AWS (advanced wireless services) spectrum that comes in the mid-band. The mid-band is particularly useful for managing increasing wireless data traffic due to its relative coverage and capacity attributes.

Gaining depth in AWS and overall mid-band coverage

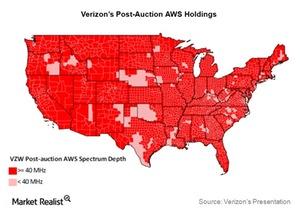

Verizon got 181 licenses spanning 192 million people through the spectrum auction. According to Verizon, the AWS-3 spectrum acquisition helped it gain depth in its spectrum holdings. Before the auction, the company’s AWS-1 spectrum holdings were low in the western part of the country compared to the eastern part. Post-acquisition, Verizon had a relatively balanced AWS holding across the nation.

According to the company, after the acquisition, its AWS spectrum holdings over 40 MHz (megahertz) cover ~95% of the population. Before the auction, these holdings covered ~70% of the population.

The acquisition has also helped the company bolster its coverage in the mid-band spectrums over 60 MHz across the country, from ~55% before the transaction to ~84% after the transaction.

If you want to take on diversified exposure to Verizon, you can invest in the Technology Select Sector SPDR Fund (XLK). The ETF held ~5% in the company on March 19, 2015.

You can also get more diversified exposure to the telecommunication company by investing in the iShares Russell 1000 Growth ETF (IWF). The ETF held ~1.8% in the company on the same date.