Has US Steel Finally Solved Its Pension Woes?

US Steel’s (X) pension plan was overfunded by $223 million at the end of 2007. But in 2009, the company’s pension plan was underfunded by a whopping $1.7 billion.

Nov. 20 2020, Updated 1:27 p.m. ET

US Steel’s pension plan

US Steel’s (X) pension plan was overfunded by $223 million at the end of 2007. But things changed after that, and in 2009, US Steel’s pension plan was underfunded by a whopping $1.7 billion.

To add to the struggles, the retiree medical and life insurance plans were also underfunded by $2.9 billion. Interestingly, for a brief period during 2009, US Steel’s market capitalization went below its liability towards retirees and life insurance plans. AK Steel (AKS) also faced a similar situation a few years back. AK Steel currently forms 3.87% of the SPDR S&P Metals and Mining ETF (XME). ArcelorMittal (MT) and Gerdau SA (GGB) are the other major steel plays.

Funded status improved

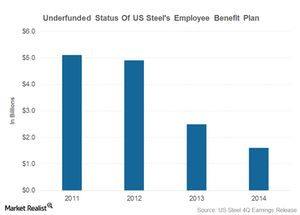

The previous chart shows the status of US Steel’s employee benefit plans. The combined underfunded status of its pension plan has come down by $0.9 billion in 2014, which is positive for US Steel investors. Currently, the plan is underfunded by $1.6 billion. Pension obligations are contractual obligations for a company.

US Steel has reduced the discount rate for its pension and other post-employment benefits (or OPEB). The reduction of discount rate leads to an increase in a company’s pension obligations.

Deconsolidation of Canadian operations

US Steel had deconsolidated its Canadian operations last year. Its Canada operations accounted for ~$1 billion of its consolidated employee benefit liability. The reduction in US Steel’s pension and OPEB obligations could largely be attributed to deconsolidation of its Canadian operations.

In this series so far, we have discussed the 4Q14 financial results of US Steel. In the next part, we’ll analyze US Steel’s 2015 outlook.