Why growth shifted in the global automotive industry

The automotive industry is geographically concentrated. The top 15 countries produce 88% of the world’s vehicles. Almost all of the G20 nations have a manufacturing unit.

Dec. 15 2015, Updated 7:09 p.m. ET

A regionalized industry

Making cars is a complex business. Only 13 nations in the world have the design, engineering, and manufacturing capabilities to build a car from scratch. The automotive industry is geographically concentrated. The top 15 countries produce 88% of the world’s vehicles. Except for Saudi Arabia, all of the G20 nations have a manufacturing unit.

Even though automakers spread their wings globally, the automotive industry remains regionalized. Socioeconomic trends, infrastructure development, customer requirements, and government regulations drive this phenomenon.

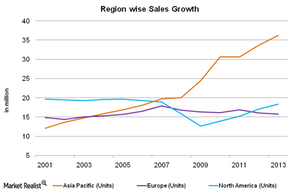

Asia-Pacific region zooms ahead

Domestic demand growth, increasing competition, and high tax imposition on CBU (completely built unit) and CKD (completely knocked down unit) led global manufacturers to set up full-scale assembly plants in emerging markets. CBU are vehicles imported in a fully assembled state. They’re ready to be sold in the target market. For CKD, individual parts are imported, but the vehicle is assembled locally.

The Asia-Pacific region broke into the automotive strongholds of North America and Europe. Asia-Pacific’s contribution to world sales increased from 2.7% in 1993 to 47.6% in 2013. This was largely due to the rapid pace of growth seen in the developing economies in China, India, and Indonesia.

The North American market also picked up after the financial crisis. To date, it posted its best year since 2006. Pent up demand, low interest rates, and cheaper fuel prices drove the resurgence.

Europe lags behind

Manufacturers suffered because of their exposure to the European market. The market refused to grow. In the Eurozone, the unemployment rate reached a 20-year high of 12% in April 2013. It’s still at 11.5%. Due to excess capacity, European automakers have been struggling to keep units profitable.

General Motors (GM) shut down its Opel plant in Bochum, Germany. PSA Peugeot Citroen, Europe’s second largest automaker, closed its 40-year-old plant in Aulnay, France. The Ford (F) factory in Genk, Belgium, will produce its last car at the end of 2014. Honda (HMC) also shut down one of the two production lines at its Swindon plant in England.

In contrast, the South American market grew at an annual rate of 12.9% over the past decade. Brazil dominates with a market share with 67%. It’s led by Fiat Chrysler (FCAU).

The First Trust NASDAQ Global Auto Index ETF (CARZ) has holdings that include all of the world’s major auto manufacturers. Even though a number of players emerged in the past two decades, the industry continues to be dominated by a few players. Additionally, the Fidelity Select Automotive Portfolio (a mutual fund) also has a diversified portfolio of auto companies.

In the next part of this series, we’ll discuss the concentration in the industry.