MetLife is a leading player in the US insurance industry

MetLife intends to grow its retail business and expects low single-digit growth in the long term.

Feb. 26 2015, Updated 12:06 p.m. ET

The US market

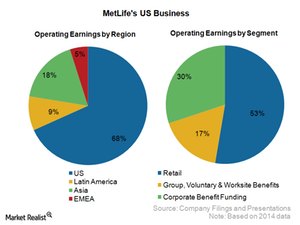

The US market is one of the key markets for MetLife (MET), contributing close to 70% of operating earnings in 2014. Here, MetLife is a key player in life insurance, annuities, and health insurance businesses with leading market shares.

Other players in the US life insurance market include Prudential Financial (PRU), Aflac (AFL), Principal Financial (PFG), and insurers in the Financial Select Sector SPDR Fund (XLF).

US business segments

The US business segments are divided into further subsegments based on end-user and product type. Retail business, which has individuals as customers, contributes more than 50% of MetLife’s operating earnings of the segment, with the remaining coming from products targeted toward corporate.

US Retail segment

The Retail segment in the US provides life, disability, property and casualty products, and annuities for individual customers. Life insurance products include variable life, universal life, term life, whole life, and annuity-type products like variable and fixed annuities.

For more information on insurance products, please read our insurance industry overview An investor’s guide to the insurance business.

MetLife undertook a business transformation in the Retail segment, resulting in strong and consistent growth in the operating earnings over the last three years. This was achieved by cost reduction and moving toward products that require the insurer to hold less capital, along with the positive impact of rising equity markets.

MetLife intends to grow its retail business and expects low single-digit growth in the long term. In recent years, the US retail business has seen annual revenue growth of ~3.5% with life and other insurance businesses growing slightly below 2% and annuity products, clocking a 6–7% sales growth.

In the next article, we will take a look at these products in more detail.