What was the key growth driver for AT&T’s wireline segment?

Adjusted revenue from IP-based strategic services grew by 14.3% YoY in 4Q14. Adjusted consumer wireline revenue increased by 2.4% during the quarter.

Nov. 20 2020, Updated 3:29 p.m. ET

AT&T’s wireline segment – revenue contribution

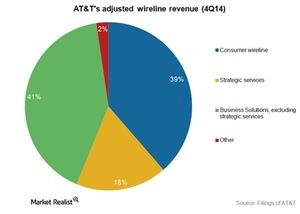

The two growing, large segments of AT&T’s (T) wireline division are strategic services and consumer wireline. As you can see in the following chart, together these segments represented 57% of the company’s adjusted wireline revenue in 4Q14. The revenue is adjusted for the impact of the sale of the Connecticut operations to Frontier Communications (FTR).

Adjusted revenue from IP-based strategic services grew by 14.3% year-over-year, or YoY, in 4Q14. Adjusted consumer wireline revenue increased by 2.4% during the quarter.

The company’s largest segment is Business Solutions. It continues to dampen the company’s overall wireline growth. Even after excluding its fast-growing strategic services sub-segment, it contributed to 41% of AT&T’s adjusted wireline revenue during the quarter. Business Solutions’ revenue decreased by ~1.8% YoY in 4Q14. However, the segment would have declined by 0.5% YoY if we exclude certain items. These items include the segment’s discontinued business in global hubbing and the impact of foreign exchange.

U-verse is the main growth driver

Consumer wireline is the segment with the most significant growth in AT&T’s wireline division. As you can see in the above chart, consumer wireline contributed 39%. Strategic services contributed to 18% of AT&T’s wireline base in 4Q14. The biggest service of consumer wireline is U-verse. It’s similar to Verizon’s (VZ) FiOS.

U-verse contributed to 67% of AT&T’s consumer wireline revenue in 4Q14. U-verse revenue is growing at an even faster pace than strategic services. The company is focusing on the segment to compete effectively with cable companies. Cable companies can provide much faster internet speeds than telecommunications companies—especially in the traditional digital subscriber lines, or DSL, internet services.

Apart from broadband, AT&T also competes with these cable companies through its U-verse video services. After the integration of DIRECTV (DTV)—if the proposed merger goes through—AT&T expects to compete effectively with these cable companies.

AT&T is the second largest US telecommunications company by market capitalization. The Technology Select Sector SPDR ETF (XLK) held ~4.4% in AT&T at the end of January 2015.

For the latest updates, visit Market Realist’s Tech, Media, and Telecom page.