An important overview of Las Vegas Sands, a casino company giant

An overview of Las Vegas Sands (LVS) shows that the company currently owns 70.1% of Sands China Ltd., which operates LVS’s four Macao properties.

Nov. 19 2019, Updated 7:12 p.m. ET

An overview of Las Vegas Sands

The Nevada-based Las Vegas Sands (LVS) was established in 1988. Las Vegas Sands develops, owns, and operates integrated resorts in Macao, Singapore, and the United States. The company’s integrated resorts feature accommodations, gaming, entertainment and retail facilities, convention and exhibition facilities, and other amenities.

An overview of Las Vegas Sands (LVS) shows that the company currently owns 70.1% of Sands China Ltd. (or SCL), which operates LVS’s Macao properties. Las Vegas Sands is listed in the New York Stock Exchange (or NYSE) under the ticker symbol LVS. The ordinary shares of its subsidiary SCL are listed on the Main Board of the Stock Exchange of Hong Kong Limited (or SEHK).

LVS is currently developing The Parisian Macao, an integrated resort at Cotai Strip. The total cost of the project is $2.7 billion and is anticipated to open in part in late 2015.

Revenue-generating properties

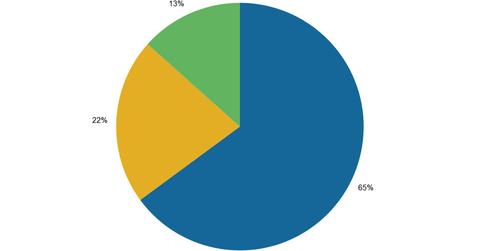

In Macao, LVS owns and operates the following four casino resorts: The Venetian Macao, Sands Cotai Central, Four Seasons Hotel Macao, and Sands Macao. LVS generates ~65% of its revenues from Macao.

In the United States, LVS owns and operates The Venetian, The Palazzo, and Sands Expo in Las Vegas, Nevada, and Sands Bethlehem in Bethlehem, Pennsylvania. LVS generates ~13% of its revenues from the United States.

In Singapore, LVS owns and operates the Marina Bay Sands. LVS generates ~22% of its revenues from Singapore.

LVS’s competitors and series overview

LVS’s main competitors include Wynn Resorts (WYNN), MGM Resorts International (MGM), Melco Crown Entertainment (MPEL), Galaxy Entertainment Group, and SJM Holdings.

ETFs such as the VanEck Vectors Gaming ETF (BJK) help investors gain access to these casino companies. BJK has the highest exposure of ~8.3% to LVS.

In this series, we’ll discuss Las Vegas Sands’ (LVS) 4Q14 results and find out why its earnings increased despite a fall in revenues. We’ll also discuss why Las Vegas Sands will burn huge amounts of cash in 2015. We’ll look at its debt-paying capacity, its valuation, its forward dividend yield, and its future prospects.