Panera Bread’s Cost Of Operations – Food Inflation And Labor

Labor expenses increased by 1.15% to 31.11% as a percentage of related sales from last year. The increase affected the company’s bakery operating margins.

Feb. 23 2015, Updated 3:05 p.m. ET

Cost of operations

In the last part of this series we learned that Panera Bread’s (PNRA) revenue grew 1.6% year-over-year, or YoY. The company also needs to manage its costs effectively in order to reap healthy operating margins.

However, there are some costs that are out of the company’s control—like food inflation. Let’s look at the company’s major cost of operations below.

Food inflation

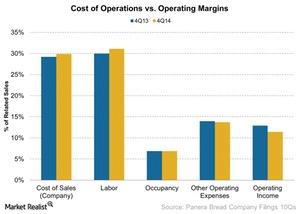

Panera Bread’s cost of sales, or food costs, increased slightly by 0.66% to 29.86%. Overall, the company faced a food inflation if 2% YoY—primarily due to dairy and butter. This inflation affected other players in the restaurant industry as well—like Chipotle Mexican Grill (CMG). To learn more read Chipotle Mexican Grill’s food costs.

To counter food inflation, restaurant chains increased their menu prices—like Brinker International (EAT). To learn more read Why Brinker International has to manage its costs.

Some of these companies are included in the Consumer Discretionary Select Sector SPDR Fund (XLY). XLY holds 4% of McDonald’s. It also holds other restaurant stocks—like Starbucks (SBUX) and Yum! Brands (YUM).

Labor

Labor expenses increased by 1.15% to 31.11% as a percentage of related sales from last year. The increase affected the company’s bakery operating margins. The margins declined by 1.46%. The labor cost increased due to increasing labor hours, increasing wages at the managerial level, and opening new delivery units.

Other operating expenses and occupancy costs

Other operating expenses decreased by 0.26% to 13.69% as a percentage of related sales—compared to 13.95% in the same quarter last year. Over the same period, occupancy costs increased slightly by 0.03% to 6.89%.

Operating margins

Due to the cost pressures mentioned above, the operating margins declined to 11.45% as a percentage of sales. The operating margins were 12.91% in the same period last year. Operating margins also declined due to Panera Bread’s investment in enhancing customer experience and structural changes.

In the next part of this series, we’ll discuss Panera Bread’s bottom line.