Fannie Mae TBAs Rise with the Bond Market

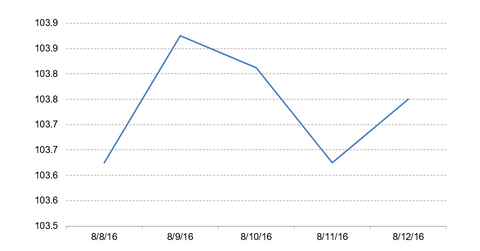

For the week ending August 12, 2016, Fannie Mae TBAs ended at 103 24/32—up 4 ticks for the week. The ten-year bond yield fell by 8 basis points to 1.51%.

Dec. 4 2020, Updated 10:53 a.m. ET

Fannie Mae and the TBA market

When the Fed talks about buying MBS (mortgage-backed securities), it’s referring to the TBA (to-be-announced) market. The TBA market allows loan originators to take individual loans and turn them into a homogeneous product that they can trade. TBAs settle once a month.

Fannie Mae loans go into Fannie Mae securities. Also, TBAs are broken down by coupon rate and settlement date. In the above graph, you can see Fannie Mae’s 3% coupon for August delivery.

Fannie Mae TBAs fall with the bond market

For the week ending August 12, 2016, Fannie Mae TBAs ended at 103 24/32—up 4 ticks for the week. The ten-year bond yield, tradable through the iShares 20+ Year Treasury Bond ETF (TLT), fell by 8 basis points to 1.51%.

Implications for mortgage REITs

Mortgage REITs such as Annaly Capital Management (NLY), American Capital Agency (AGNC), and MFA Financial (MFA) are the biggest non-central bank holders of TBAs. They use the TBA market as a vehicle to quickly increase and decrease exposure to MBS.

TBAs are highly liquid and much easier to trade than a portfolio of older MBS. Non-agency REITs such as Two Harbors Investment (TWO) are less likely to trade TBAs. Investors interested in exposure to the mortgage REIT sector through an ETF can look at the iShares Mortgage Real Estate Capped ETF (REM).

In general, you can consider mortgage REITs among the biggest lenders in the mortgage market. When TBAs rise, mortgage REITs see capital gains. These gains increase TBAs’ returns, especially when added to their interest income.

In the final part of our series, we’ll look at Ginnie Mae TBAs.