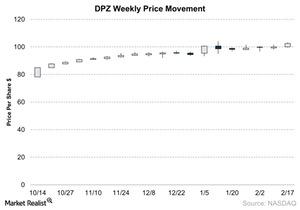

Domino’s Stock Jumps 21% Since Last Earnings Release

Year-to-date, Domino’s stock is up 8.7%, as of February 20. It has rocketed 21% since the company’s last earnings release in October 2014.

Nov. 20 2020, Updated 3:14 p.m. ET

Domino’s stock sees substantial increase

So far in this series, we’ve covered expectations for Domino’s Pizza (DPZ) same-store sales, unit growth, revenues, and EBITDA (earnings before interest, tax, depreciation, and amortization). The company is expected to release its fourth quarter 2014 earnings on February 24. Year-to-date, Domino’s stock is up 8.7%, as of February 20. DPZ stock has rocketed 21% since its last earnings release in October 2014.

Wall Street analyst estimates

These are the highlights from Wall Street’s consensus estimates for Domino’s fourth quarter:

- revenues – $616 million

- EBITDA – $118 billion, with an EBITDA margin of 19.27%

- adjusted net income – $52 million, with earnings per share of $0.93

- more new units added during the quarter

- same-store sales growth – 6.6%

We’ll publish a post-earnings report soon, so make sure to mark your calendar and come back after February 24.

Restaurant stocks fall under the consumer discretionary sector and are components of the Consumer Discretionary Select Sector SPDR Fund (XLY). The XLY portfolio includes ~4% in McDonald’s (MCD) stock, ~3% in Starbucks (SBUX), and ~1% in Chipotle Mexican Grill (CMG).

Further reading

Read previously published series to learn more about the restaurant industry:

- Shake Shack Filed For An IPO—What Investors Need To Know

- An in-depth overview of the US restaurant industry