Compensation packages at Blackstone among the best in the biz

Blackstone’s performance fees have increased more than its basic compensation costs because the companies in which it invests have performed so well.

Feb. 27 2015, Updated 11:05 a.m. ET

Compensation and benefits

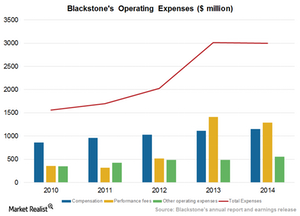

The private equity business derives value from the effective management of its operating companies as well as the returns generated for its unitholders. As a result, the majority of a company’s expenditures are related to compensation and benefits for its fund managing teams. Compensation and benefits include basic compensation and performance fees. Basic compensation includes salaries, bonuses, and equity-based rewards to senior managing directors and other employees.

Performance fees, on the other hand, include incentive fee allocations to senior managing directors’ and selected employees’ part of the profit-sharing incentives.

Over the past five years, Blackstone Group (BX) spent an average of 37% of its revenues on compensation and benefits. The firm’s other operating expenses amount to around 7%–10% of total revenues.

Blackstone’s compensation costs are slightly higher than those of other players such as Carlyle Group (CG), KKR & Co. (KKR), Apollo Global Management (APO), and T. Rowe Price Group (TROW). TROW makes up 0.72% of the Financial Select Sector SPDR Fund (XLF).

Performance drives compensation

Compensation is more based on the total of the funds under management. Performance fees or benefits are based on the performance of the investment funds. Blackstone’s performance fees have increased more than its basic compensation costs because the companies in which it invests have performed so well.

Blackstone’s focus is on retaining talent across industries. In this way, it improves the operational performance of its holding companies. To do so, the company must maintain dynamic and high-performance pay structures. As performance and scale improve, we expect compensation costs on the whole to rise. Yet they should remain in the 30% to 35% range of total revenues.