Why Cliffs plans to reduce its capex going forward

Cliffs Natural Resources’ (CLF) estimation for the 2015 annual capital expenditure, or capex, is $125–$150 million.

Nov. 19 2019, Updated 6:37 p.m. ET

Cliffs’ capex

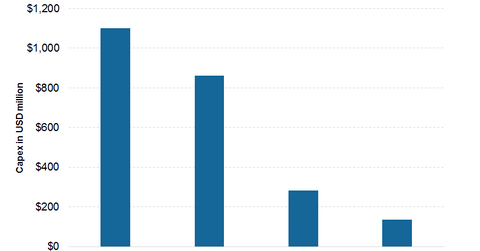

Cliffs Natural Resources’ (CLF) estimation for the 2015 annual capital expenditure, or capex, is $125–$150 million. This is against the capex requirements of $284 million in 2014, $862 million in 2013, and $1.1 billion in 2012.

These huge capex requirements were mainly to fund the Bloom Lake mine. Now that the company decided to put this asset into bankruptcy, it has to allocate less than $150 million in capex for the entire company in 2015.

Low capital needs for APIO

Cliffs’ strategy for Asia Pacific Iron Ore, or APIO, is to keep looking for suitable buyers. It plans to keep operating the mine in the meantime. However, the company doesn’t have any plans to continue operating the mine beyond its remaining five-year life. The total capex necessary during the five years is only $50 million. Then, the company will completely exit the Australia and China trade.

Coal capex

Cliffs sold Logan County Coal. For its other two coal mines, it expects to operate them at an EBITDA (earnings before interest, tax, depreciation, and amortization) neutral level until suitable buyers come forward. These mines shouldn’t consume much capex. The company will maintain these mines to meet its important safety and environmental requirements. It will also meet its permission to operate commitments and basic maintenance expenses.

USIO focus

Going forward, Cliffs’ main focus will be on the US Iron Ore (or USIO) segment. Management expects the segment to consume no more than $100 million of capex annually.

As a result, with the selling or closing down of non-core assets, including non-US and non-iron ore assets, the company expects to reduce its capex substantially lower in the coming years. Other iron ore miners, including BHP Billiton (BHP), Rio Tinto (RIO), and Vale SA (VALE) are also resorting to measures to reduce costs and increase efficiencies.

ETFs—like the SPDR S&P Metals and Mining ETF (XME)—are another way of investing in this sector. Cliffs forms 3.69% of this XME’s holdings.