Starbucks China and Asia-Pacific Segment Reports Record Sales

The Starbucks China and Asia-Pacific segment grew 85% to $495 million, up from $266 million year-over-year.

Feb. 5 2015, Updated 9:05 a.m. ET

Top line performance

After looking at revenue drivers in the previous parts of this series, we’ll now try to understand how these drivers impact Starbucks (SBUX) revenue.

Starbucks reported revenues of $4.8 billion from three sources:

- company-operated stores – 79%

- licensed stores – 10%

- consumer packaged goods, food services, and other – 11%

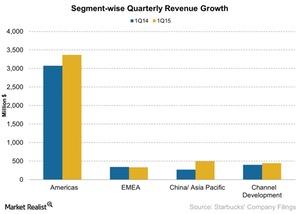

The chart shows a breakdown of revenue by segment by geography.

The Americas segment

As noted earlier, 70% of Starbucks revenues come from the Americas segment. Looking at the graph above, we can see that this segment’s revenues grew 9.5% to $3.3 billion, from $3 billion in the corresponding quarter a year ago.

McDonald’s (MCD) has the biggest share of the US fast-food segment and has challenged other chains, including Starbucks and Dunkin’ Brands (DNKN), with its new breakfast menus.

China and Asia-Pacific segment reports record sales

The Europe, Middle East, and Africa, or EMEA, segment and the China and Asia-Pacific segment contributed 6.9% and 10.3%, respectively, to Starbucks revenues in 1Q 2015. In terms of growth, EMEA segment revenues declined by 1.8% to $333 million, down from $339 million year-over-year. The Starbucks China and Asia-Pacific segment grew 85% to $495 million, up from $266 million year-over-year.

China is also Yum! Brand’s (YUM) key market.

In the next section of this series, we’ll discuss channel development.

Investors who would like to invest in the restaurant industry as a whole can invest in the Consumer Discretionary Select Sector SPDR Fund (XLY).