A key analysis of ExxonMobil’s revenues

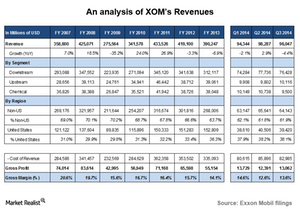

ExxonMobil’s businesses and revenues depend on crude oil and natural gas’ price levels. In the first three quarters of 2014, ExxonMobil reported revenues of ~$290 billion.

Jan. 12 2015, Updated 1:54 p.m. ET

ExxonMobil’s metrics

Earlier in this series, we analyzed ExxonMobil’s (XOM) upstream production—oil and gas. We also looked at the company’s downstream throughput—refining. Upstream and downstream production are very important metrics for an integrated energy company. The metrics are definitely important for a company with such large upstream and refining operations.

Investors want to know how these operational numbers translate into revenues. In this part of the series, we’ll analyze ExxonMobil’s revenues.

Revenues

ExxonMobil’s businesses and revenues depend on crude oil and natural gas’ price levels. Over the years, the company’s revenues have seen swings broadly in line with energy prices.

In the first three quarters of 2014, ExxonMobil reported revenues of ~$290 billion. For the same period, Chevron (CVX) and Total S.A. (TOT) reported about half that amount. BP (BP) reported about the same. Royal Dutch Shell Plc (RDS.A) reported revenues near $330 billion.

ExxonMobil and Chevron are two American integrated companies. They’re the top two holdings of the iShares U.S. Energy ETF (IYE). The ETF is good way to gain diversified exposure to ExxonMobil, Chevron, and other American energy companies.

By segment

Looking at ExxonMobil’s revenues by segment, its refining business shows outsized numbers. This is because of the sheer volume of crude that passes through its refineries each year. However, this is misleading. In the refining business, profit margins are quite thin. We’ll analyze this later in this series.

ExxonMobil’s other two divisions—upstream and chemicals—hold comparable sway in terms of revenues.

By region

Looking at ExxonMobil’s revenues by region, we can see that the US is becoming more important in its business.

Like we saw with its upstream production, an increasing share of ExxonMobil’s revenues have been coming from its US operations. The US accounted for less than one-third of its revenues in 2007. Now, the US accounts for almost 40% of its revenues.

In the next parts of this series, we’ll discuss ExxonMobil’s earnings in more detail.