Caesars Entertainment’s New Corporate Structure and Governance

On December 22, 2014, CZR and Caesars Acquisition Company (CACQ) entered into a definitive agreement to merge in an all-stock transaction.

Nov. 27 2019, Updated 7:39 p.m. ET

Restructuring

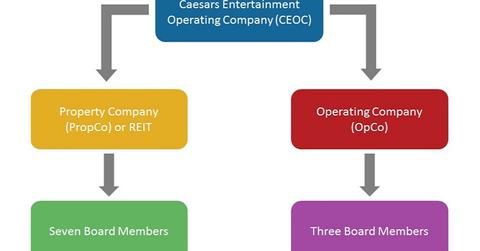

Caesars Entertainment’s (CZR) operating unit, Caesars Entertainment Operating Company (or CEOC), will restructure as a separate operating company (or OpCo) and property company (or PropCo), with a real estate investment trust (or REIT) directly or indirectly owning and controlling PropCo.

PropCo will own all of CEOC’s real property. A separate subsidiary of PropCo will own all the assets of Caesars Palace Las Vegas (or CPLV).

CEOC’s board composition

OpCo will have three board members, with CZR appointing either two or three such members, depending on whether it owns 90% or more of the equity. If CZR appoints all three members, then one member will be independent.

The REIT will have seven board members, with the holders of the first lien notes appointing either six or seven of the members, depending on whether the first lien note holders own 90% or more of the equity.

Merged entity structure

On December 22, 2014, CZR and Caesars Acquisition Company (CACQ) entered into a definitive agreement to merge in an all-stock transaction. This merger would result in CZR owning high-growth assets and a majority stake in Caesars Interactive Entertainment (or CIE).

Gary Loveman will be the chair and CEO of the merged company. Mitch Garber, CEO of CACQ, will be CEO of CIE. Following the merger, Garber will join the Board of Directors of CZR as vice chair.

Investors who are looking to hold a diversified portfolio in leisure companies may consider investing in ETFs like VanEck Vectors Gaming (BJK), the Consumer Discretionary Select Sector SPDR Fund (XLY), and PowerShares Dynamic Leisure and Entertainment (PEJ).