Starbucks Is Expanding By Taking On Debt

SBUX’s total debt increased from $1.3 billion to $2 billion. It issued long-term debts in 4Q13 and 1Q14. This increased the interest expense by $36 million.

Dec. 30 2014, Updated 2:39 p.m. ET

Funding unit growth

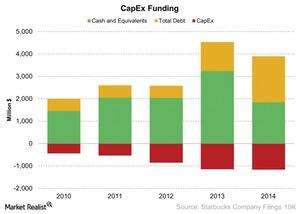

In the last part of this series, we saw that Starbucks (SBUX) is aggressively growing its units. Now, we’ll look at how SBUX is funding its unit growth. Starbucks sources its capital requirements for new restaurant construction. SBUX sources its cash and investment balance as well as cash flows from operations and debts.

In the above chart we see that SBUX’s capital expenditure in 2014 was $1.1 billion. It was about the same as 2013. The company’s cash and cash equivalents balance declined 42% year-over-year, or YoY, from $3.2 billion to $1.8 billion. The total debt increased from $1.3 billion to $2 billion.

The company issued long-term debts in 4Q13 and 1Q14. This increased the interest expense by $36 million. While the increase in debt position should raise concern for equity investors, it also saves a company its tax dollars. Interest is tax exempt. Striking the right balance is important.

Restaurant companies don’t have long receivable periods because customers pay with cash or credit cards.

Peer debt position

It’s best to look at debt in terms of ratio to compare peer companies. SBUX’s debt-to-EBITDA (earnings before interest, tax, depreciation, and amortization) ratio was 0.5x. The debt-to-EBITDA ratio for Dunkin’ Brands (DNKN) was 4.8x. Keep in mind that a lower number is better.

Chipotle Mexican Grill (CMG), Potbelly (PBPB), and Buffalo Wild Wings (BWLD) don’t have debt. They use their internal sources to finance their operations. This is possible because of the nature of the restaurant industry.

To invest in several restaurant stocks while minimizing your transaction costs, you may want to look at the SPDR S&P 500 ETF (SPY).

SBUX is also using these fund sources to grow Teavana units. We’ll discuss this in more detail in the next part of this series.