The salient features of mutual funds

There are investors who are willing to take on higher risk to generate above-average market returns. For these investors, active funds offer the optimal investment avenue.

Nov. 27 2019, Updated 7:46 p.m. ET

Active mutual fund proponents don’t believe markets are efficient

Mutual funds, with the exception of index funds, which we’ll discuss later on in this series, have a few salient features.

First, mutual funds proponents don’t believe in the efficient market hypothesis. The efficient market hypothesis is a financial principle that essentially maintains that markets price securities correctly, and so outperforming the market isn’t possible. Active mutual fund proponents believe that there are falsely priced securities and that if you pick securities correctly, you can outperform the market.

Asset managers including Franklin Templeton (BEN), T. Rowe Price (TROW), Legg Mason (LM), and Janus Capital Group (JNS) are traditionally big players in active fund management. All of these companies are components of the Financial Select Sector SPDR (XLF).

Active mutual funds depend on fund managers to a large extent

Since mutual fund proponents believe that making the right security selection is all that’s required to outperform the market, they also believe the role of the mutual fund manager is paramount. After all, this is the person who selects the securities.

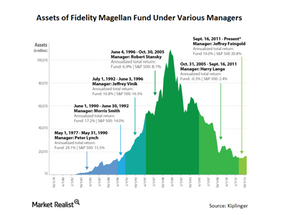

Iconic fund manager Peter Lynch consistently managed to outperform the market. As you can see in the chart above, the assets of the Fidelity Magellan Fund, managed by Lynch, rose exponentially during his tenure on consistent outperformance. But when he left, the fund’s performance dropped. The halo surrounding the fund disappeared, and assets fell dramatically over the next decade.

Active mutual fund provide avenues to high-risk investors

Not all investors are risk averse or risk neutral. There are investors who are willing to take on higher risk to generate above-average market returns. For these investors, active funds offer the optimal investment avenue.

And, these funds are known to have sometimes rewarded investors. The Fidelity Magellan Fund (FMAGX) averaged returns of nearly 30% over 29 years between 1977 and 1990. In 2014, a small fund focused on Indian equities, Matthews India Investor, beat most other funds hands down when it generated more than a 60% return for the year.