Personal Consumption Expenditure Remains Low

Slow growth in personal consumption expenditure may affect growth. Currently, personal consumer expenditure is $12 trillion. This is ~70% of the GDP.

Dec. 10 2014, Updated 2:59 p.m. ET

The one segment of the U.S. economy that still appears to be lagging is also the biggest: household consumption. Russ explains why slower consumer spending is likely to drag down U.S. economic growth, noting three implications for investors.

The one segment of the U.S. economy that still appears to be lagging is also the biggest: household consumption.

Looking forward, household consumption – as distinguished from business spending, which I believe will accelerate – most likely won’t pick- up significantly anytime soon.

Market Realist – Slow growth in personal consumption expenditure may affect growth.

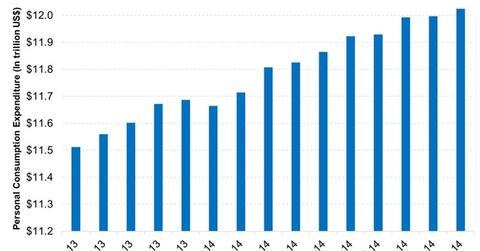

The graph above shows the personal consumption expenditure in the US for the last 15 months. Although the trend is upward, consumption expenditure only inched up—especially in the last three months. Currently, personal consumer expenditure is $12 trillion. This is ~70% of the gross domestic product, or GDP.

The GDP growth increased in the last two quarters. It helped the S&P 500 (SPY)(IVV) reach all-time highs. However, personal consumption expenditure has been growing slowly. Although the GDP grew by 3.9% in the third quarter, personal consumption expenditure didn’t contribute to the increase. In the next parts in this series, we’ll explain the factors that affected consumption. We’ll also discuss why this trend will likely continue for a while.

Consumer spending affects sectors like consumer staples (XLP), consumer discretionary (XLY), and retail (XRT). The revenues in these sectors are directly affected by disposable income—especially XLY and XRT.