Why Enterprise Products Partners is important to investors

EPD is a leading midstream service provider in the natural gas, natural gas liquids (or NGLs), crude oil, petrochemicals, and refined products sectors.

Nov. 20 2020, Updated 10:52 a.m. ET

Company overview

Enterprise Products Partners (EPD) is one of the largest midstream master limited partnerships (or MLPs). It’s a significant part of the Alerian MLP ETF (AMLP). EPD is a leading midstream service provider in the natural gas, natural gas liquids (or NGLs), crude oil, petrochemicals, and refined products sectors. It offers its services to the energy producers and consumers.

EPD released its 3Q14 earnings on October 30. We’ll discuss the earnings in this series. Before we analyze the company’s performance in 3Q14, we’ll look at EPD’s operations.

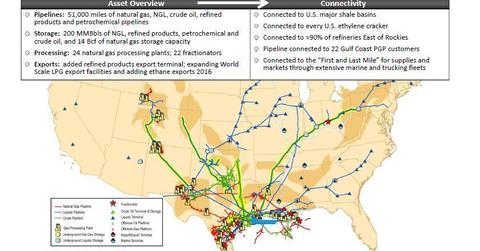

The company’s operations include:

- Natural gas gathering, treating, processing, transportation, and storage

- NGL transportation, fractionation, storage, and liquefied petroleum gas (or LPG) export terminals

- Crude oil gathering, transportation, and storage

- Offshore pipeline services

- Petrochemical and refined products transportation

- Marine transportation

As of September 2014 its assets include:

- 52,000 miles of onshore and offshore pipelines

- 220 million barrels (or MMbbls) of storage capacity for NGLs, petrochemicals, refined products, and crude oil

- 14 billion cubic feet (or Bcf) of natural gas storage capacity

- 24 natural gas processing plants

- 22 NGL and propylene fractionators

- Six offshore hub platforms located in the Gulf of Mexico

- A butane isomerization complex

- NGL import and LPG export terminals

A brief history

In September 2006, EPD formed Duncan Energy Partners (DEP) to acquire, own, and operate midstream energy assets. In September 2011, in an effort to streamline its organizational unit and optimize operational costs, DEP merged into EPD as its subsidiary.

Recently, Kinder Morgan Inc. (KMI) expressed its intentions to merge its midstream subsidiaries—Kinder Morgan Energy Partners (KMP) and El Paso Pipelines Partners (EPB)—into KMI. For details on the merger, read our article “Everything you need to know about the Kinder Morgan consolidation.”

Other MLPs operating in the midstream energy sector are Energy Transfer Partners (ETP) and Plains All American Pipeline (PAA). All of these companies are part of the Alerian MLP ETF (AMLP).

One-year unit price up

Since EPD is a MLP, its units—and not shares—are traded in the stock exchange.

EPD’s unit price increased ~22% in the past year. On October 30, the day EPD released its 3Q14 financial results, its unit price went down by 2% from the previous day’s close.

Investors may note that on July 15, 2014, EPD declared a two-for-one stock split by distributing one additional common unit for each common unit outstanding.