How Nabors Could Use Its Free Cash Flow This Year

Nabors Industries’ (NBR) CFO (cash from operating activities) turned positive in 2Q17, compared with its negative CFO in 1Q17.

Aug. 21 2017, Updated 9:06 a.m. ET

NBR’s operating cash flows

Nabors Industries’ (NBR) CFO (cash from operating activities) turned positive in 2Q17, compared with its negative CFO in 1Q17. NBR generated $48 million CFO in 2Q17.

However, NBR’s CFO fell 72% YoY (year-over-year) in 2Q17. The higher working capital requirement as a direct result of an increase in the level of drilling activity and poor working capital management led to NBR’s deteriorating CFO in 2Q17 on a YoY basis.

NBR’s free cash flow

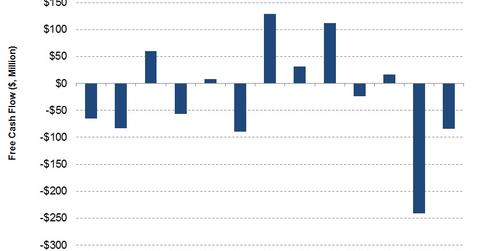

NBR’s capital expenditure or capex had more than doubled in 2Q17 on a YoY basis. The company’s lower CFO and higher capex led its FCF (free cash flow) to deteriorate significantly in 2Q17 YoY.

In 2Q17, NBR’s FCF was -$84 million, compared with $112 million in 2Q16. In seven of the past 13 quarters, its FCF had been negative.

FCF comparison with peers

Tesco (TESO) generated -$12 million in FCF in 2Q17. Oceaneering International’s (OII) FCF was $5.3 million in 2Q17, while Oil States International’s (OIS) 2Q17 FCF was $5.9 million.

Notably, NBR makes up 0.12% of the iShares North American Natural Resources ETF (IGE). IGE has fallen 9% in the past year, compared with the 36% dip in NBR’s stock price.

NBR’s 2017 capex estimates

In 2017, NBR expects to spend between $550 million and $600 million in capex. This would be 44% higher than its 2016 capex. NBR expects to allocate its future free cash flow generation toward debt reduction.

For more on the OFS (oilfield services and equipment) industry, check out Market Realist’s The Oilfield Equipment and Services Industry: A Primer.