Why investors should learn about MGM’s top shareholders

As an investor, you should know whether or not MGM’s (MGM) management is committed to its future. Management shows its commitment by owning shares.

Nov. 20 2020, Updated 3:38 p.m. ET

Insider holding

As an investor, you should know whether or not MGM’s (MGM) management is committed to its future. Management shows its commitment by owning shares. Investors want to know that management if confident about the company’s business. However, weak market and poor company fundamentals could hurt the share price even if management is buying its shares.

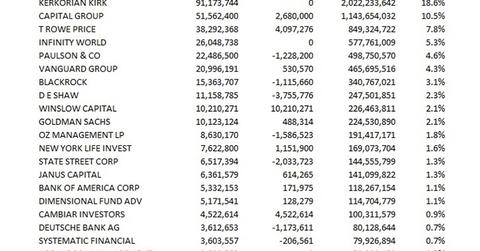

The above chart shows that Kerkorian Kirk, a director emeritus of MGM, is the company’s largest shareholder. As of September 2014, it had 18.6% stake..

A significant reduction in management’s stake impacts the stock price. It could put the stock under selling pressure. However, investors shouldn’t make any decision based only on the stake change. Investors should consider the company’s fundamentals and valuations.

Companies—like Las Vegas Sands (LVS) and Wynn Resorts (WYNN)—have insider ownership of ~49% and 20%, respectively. However, Caesars Entertainment (CZR) has insider ownership of ~1%.

A good way for investors to gain access to these companies is to invest in an exchange-traded fund (or ETF) like the Consumer Discretionary Select Sector SPDR Fund (XLY).

Institutional investors

An increase in insider stake won’t always give a positive signal about the company. A significant presence of institutional investors could indicate that insiders don’t have room to make and carry out random decisions. Although the decisions benefit them, they can’t gauge how they will impact the other shareholders.

The above chart shows that institutional shareholders—like mutual funds, pension funds, banks, hedge funds, private equity firms, and other financial institutions—hold ~76% of MGM.

In the next part of the series, we’ll discuss how MGM is valued in the market.