Point72 Asset Management raises position in Insmed

“If approved for NTM patients, we believe Arikayce would be the first and only approved inhaled antibiotic for the treatment of NTM lung infections.” – Insmed

Oct. 23 2014, Published 12:25 p.m. ET

Position summary

Steven Cohen’s Point72 Asset Management added to its positions in LogMeIn, Inc. (LOGM), AMC Entertainment Holdings Inc (AMC), Bloomin’ Brands Inc (BLMN), Insmed Incorporated (INSM), Kraton Performance Polymers, Inc. (KRA), Kindred Healthcare, Inc. (KND), Aegerion Pharmaceuticals, Inc. (AEGR), and Lumber Liquidators Holdings, Inc. (LL). New positions were initiated in Pier 1 Imports Inc (PIR), Stage Stores, Inc. (SSI), CymaBay Therapeutics Inc (CBAY), and Applied Genetic Technologies Corporation (AGTC).

Point72 Asset Management added to its position in Insmed Incorporated (INSM). A 13G filing in July notes the fund now owns 2,109,014 shares. This is up from the 651,687 shares reported in the 2Q14 portfolio. The filing said the fund owns a passive stake of 5.4% in Insmed.

Overview of Insmed

Insmed is a biopharmaceutical company dedicated to improving the lives of patients battling serious lung diseases. Insmed is focused on the development and commercialization of Arikayce (liposomal amikacin for inhalation), for at least two identified “orphan,” or unique, patient populations: patients with nontuberculous mycobacteria, or NTM, lung infections, and cystic fibrosis, or CF, patients with Pseudomonas aeruginosa lung infections.

The company notes in its 10Q that it believes “there currently is no drug approved in Europe or the U.S. for treatment of NTM lung infections, and as a result all current drug treatments for NTM are used off-label. If approved for NTM patients, we believe Arikayce would be the first and only approved inhaled antibiotic for the treatment of NTM lung infections. If approved for CF patients with Pseudomonas lung infections, we believe Arikayce would be the first inhaled antibiotic to be approved for once-daily administration in this indication.”

Insmed estimates the global market for the treatment of Pseudomonas lung infections in CF patients is approximately $500 million.

Why shares plunged in August

In June 2014, Arikayce was granted breakthrough therapy designation in the U.S. This designation was based upon the culture conversion results of the phase two clinical trial.

Shares plummeted in August after Insmed provided a regulatory update on Arikayce. Insmed informed shareholders of a Federal Drug Administration, or FDA, decision to proceed with a phase three study of the drug. It also intends to pursue a second phase three study, leading to concerns that FDA approval of the drug and its time to market could be delayed.

During 2Q14, Insmed announced plans to file a market authorization application, with the European Medicines Agency for Arikayce (liposomal amikacin for inhalation), for the treatment of the two orphan lung diseases mentioned above.

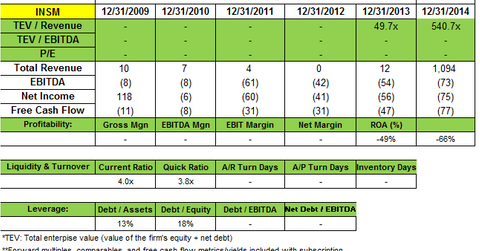

Net loss widens for 2Q14

Insmed posted a net loss of $23.2 million, or $0.59 per share for 2Q14, compared with a net loss of $8.9 million, or $0.28 per share. It said the increase in net loss was primarily due to $11.5 million in other revenue received in 2Q13. This other revenue related to a one-time payment for the sale of Insmed’s right to receive future royalties under its license agreement with Premacure, now Shire plc. Higher expenses in the 2014 quarter also contributed to the loss.

Nets $108 million from public offering

Insmed gained net proceeds of approximately $108 million from a $115.1 million underwritten public offering of shares. The proceeds will be used to fund further clinical development of Arikayce, and general corporate purposes. Insmed said these “may include the acquisition or in-license of additional compounds, product candidates, technology or businesses.”

The next part of this series will review Point72’s position increase in Kraton Performance Polymers, Inc., a global producer of engineered polymers.