Why oil and natural gas production in the Permian should increase

According to the Energy Information Administration’s short-term energy outlook published in June 2014, crude oil production will average 8.4 million barrels per day in 2014.

Nov. 22 2019, Updated 7:22 a.m. ET

The Energy Information Administration projects higher U.S. crude oil production

According to the Energy Information Administration’s (or EIA’s) short-term energy outlook published in June 2014, crude oil production will average 8.4 million barrels per day in 2014, which is an increase of 0.9 million barrels per day or 12% from the 2013 level. The EIA also anticipates that the majority of the growth will arise from the Williston Basin in western North Dakota and eastern Montana (primarily the Bakken formation), the Western Gulf Basin in south Texas (primarily the Eagle Ford Formation), and the Permian Basin (primarily the Spraberry and Wolfcamp formations).

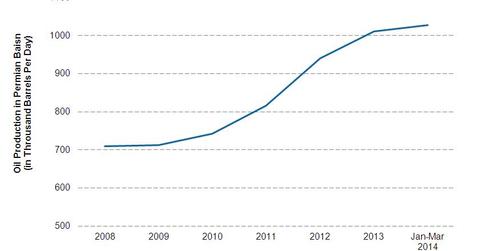

Historical oil production shows a rising trend

The Energy Information Administration also says the total U.S. crude production in 2013 was 7.5 million barrels per day, or 15% higher than 2012. Historically, this was the highest level of production in the U.S. since 1989. From January 2007 to January 2014, the daily production of crude oil in the U.S. has increased by ~56%.

Natural gas production in the U.S.

In 2013, average natural gas production was 70.2 billion cubic feet per day. The EIA estimates the continental U.S. marketed production would increase by 0.7 billion cubic feet per day and 0.4 billion cubic feet per day in 2014 and 2015, respectively, from 2013. The EIA in its Annual Energy Outlook 2013 has projected that the U.S. natural gas production will increase an estimated 44% over the next 30 years. Most of the production is expected to come from shale gas plays. Shale gas is projected to grow to 16.7 million cubic feet (or MMcf) in 2040.

Why higher shale oil–driven and gas-driven production drives higher demand for midstream services

Production has grown in the Permian Basin, as oil and gas producers have taken advantage of new technologies in order to drill previously uneconomic locations. This development has mostly used horizontal drilling (drilling sideways along the length of a hydrocarbon-rich strata) and hydraulic fracturing (using high-pressure liquids to break apart rock and release hydrocarbons). Increased production in the basin has been positive for various parties, including upstream, midstream, downstream, and services. Many oil and gas producers (upstream companies) with assets in the Permian Basin have increased their revenues by successfully drilling in the area. Plus, with increased production has come a need for increased midstream infrastructure that transports hydrocarbons away from production sites to places like oil refineries and natural gas processing plants.

Higher shale production affects oil prices too

The midstream energy sector has witnessed increasing capital investment toward oil and gas infrastructure assets. Capex increased 60% from $56.3 billion in 2010 to $89.6 billion in 2013. The increased transportation capacity from inland U.S. crude production regions to demand centers (such as refineries on the Gulf Coast) is bullish for WTI crude oil prices. Plus, the U.S. Energy Information Administration reported that stocks at the inland U.S. crude hub of Cushing continued to decrease, which may also indicate that U.S. crude produced inland is having an easier time getting to demand centers such as refineries.

The capacity constraints we witnessed in the past few years have been eased by the infrastructure construction of new pipeline and railroad infrastructure, which started to result in improving prices.

Midstream Permian companies

The midstream energy companies that engage in the transportation and logistics of crude oil and natural gas have been very active for the past five years as a result of increasing production in the Permian Basin. The master limited partnerships in the midstream space that have benefited the most from the shale boom include Enterprise Products Partners LP (EPD), Sunoco Logistics Partners LP (SXL), Magellan Midstream Partners (MMP), and Energy Transfer Partners (ETP). These are components of the Alerian MLP ETF (AMLP).