How do interest rate expectations impact financial markets?

The inflation and interest rate expectations of consumers and firms are important variables determining bond prices.

Oct. 30 2019, Updated 11:24 a.m. ET

Role of inflation and interest rate expectations in financial markets

Dr. Charles Plosser, President and Chief Executive Officer of the Federal Reserve Bank of Philadelphia, spoke at the Council on Foreign Relations in New York on May 8, 2014. The topic for discussion was “Communication and Transparency in the Conduct of Monetary Policy.” One of the key takeaways from Dr. Plosser’s speech was that monetary policy guidance is important in influencing market expectations about interest rates and inflation. In this part, we will discuss how the expectations of market participants can influence economic activity.

The inflation and interest rate expectations of consumers and firms are important variables determining bond prices. They are also key in determining the level of consumption, private investment, and debt levels in the economy. Since consumption and private investment make up ~85% of the GDP, market expectations with regard to inflation and interest rates, have important implications for GDP growth.

On prices of fixed income securities

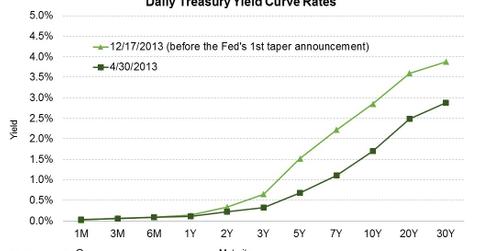

Higher inflation would increase nominal interest rates, and that in turn, would reduce bond prices, as bond prices and interest rates move in opposite directions. Market expectations about future rate increases or decreases will also impact the yield curve for Treasury securities and also impact the interest rates for other debt securities too.

For example, markets had been anticipating higher interest rates in the U.S. since the Fed first hinted at the tapering of bond purchases after its FOMC meeting in April, 2013. The 30-year Treasury yields (TLT) rose by 100 basis points between the period April 30, 2013, and December 17, 2013, in anticipation of the Fed’s taper, even before the Fed announced the onset of tapering. The prices of ETFs investing in the U.S. debt securities were also impacted by market expectations about higher rates. Price declines over the period April 30, 2013, to December 17, 2013, were as follows:

- The PowerShares Insured National Municipal Bond Portfolio (PZA) fell by ~7.7%, to $22.76.

- The iShares iBoxx $ Investment Grade Corporate Bond Fund (LQD) fell by ~3.8%, to $112.85.

- The iShares 20+ Year Treasury Bond (TLT) fell by ~14.3%, to $101.93.

The impact of market expectations on consumption

Higher levels of inflation and interest rates would lower consumption, all else equal. Higher inflation reduces the level of real income as there is typically a lag between price increases and increases in wages. Other factors remaining constant, higher levels of inflation and interest rates would also impact the demand for high-value items like houses and cars, which are more often than not, financed through borrowings. This would affect car companies like Ford (F) and homebuilders, for example, residential construction companies included in construction sector ETFs like the iShares U.S. Home Construction ETF (ITB).

Impact of market expectations on private investment

Current and future expected interest rates impact the required rates of return on project investments. Higher interest rates increase the required rates of return on future projects, as firms would have to pay higher interest costs on borrowings. Investments which are expected to yield lower than the required rates of return will be shunned, while firms would pursue those projects expected to yield higher than their required rates of return, all else equal.

For more on how the inflation expectations of firms impact the economy, read A guide to the Atlanta Fed Business Inflation Expectations Survey.

In the following part, we will discuss Dr. Plosser’s views on the applicability of Taylor-like rules in policy-making and systematic forward guidance.